Market performance was varied across the region, with the focus shifting from China and with some bright spots emerging. For instance, APAC saw a decline in private market deal value by a 14%, and total deal count down 20% which, while still sharp, is slightly more moderate than other regions.8 Exits in the region remain challenging, with India being a bright spot as it was the lone market to see an increase in exits, while Australia and New Zealand saw some sizeable third quarter transactions.

Market performance was varied across the region, with the focus shifting from China and with some bright spots emerging. For instance, APAC saw a decline in private market deal value by a 14%, and total deal count down 20% which, while still sharp, is slightly more moderate than other regions.8 Exits in the region remain challenging, with India being a bright spot as it was the lone market to see an increase in exits, while Australia and New Zealand saw some sizeable third quarter transactions.

While China has historically been a single source of strength for the region based on the exponential growth of the consumer internet segment during the prior hype cycle, recent changes have largely closed that market to North American and European investors, with a 77% decline in fundraising year-over-year through Q3.9 While we anticipate fundraising and investing in China’s US dollar vehicles to remain lower in the region during 2024, the story on the ground is more nuanced. With regional sovereign wealth funds showing increased interest in the market, local RMB-denominated vehicles are continuing to see greater activity heading into 2024.

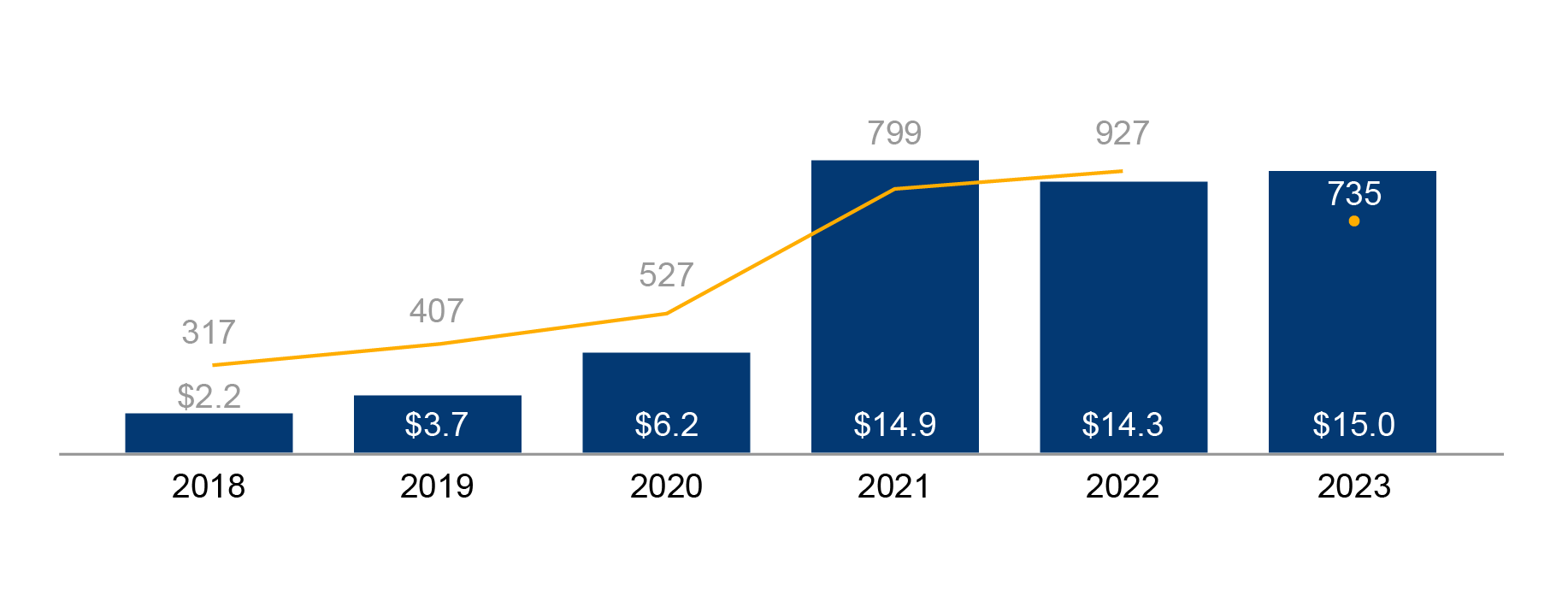

The region is undergoing dramatic shifts that are creating near-term growth opportunities in other markets like Japan, Korea, and India, particularly, in 2024. For example, Japan’s venture capital ecosystem has been growing over recent years, centered around cities such as Tokyo and Osaka. The number of venture capital-backed companies in Japan has increased six-fold since 2015, while activity levels in 2023 were on pace to exceed those of 2020.10 In India, we are seeing more interesting growth buyout opportunities on the large-end, as well as a vibrant domestic equity markets driving more interest in new-economy businesses to support the venture capital lifecycle. Similarly, while transaction value was down in the first half of the year, we are seeing more buyout opportunities in Japan, where the private market penetration has historically been relatively low, which makes for potentially exciting prospects given the above dynamics.11

Some refer to 2023 as a healthy shake out of the prior hype cycle excess. But the growth at all costs model of the last decade shifted more toward a cautious value orientation, with investors focusing on businesses — including tech businesses — with a demonstrated clear and viable path to growth and profitability.

Some refer to 2023 as a healthy shake out of the prior hype cycle excess. But the growth at all costs model of the last decade shifted more toward a cautious value orientation, with investors focusing on businesses — including tech businesses — with a demonstrated clear and viable path to growth and profitability. For Europe, 2023 was a year of instability. In regional private markets, deal counts declined 16% YoY, with deal value down 25% YoY through the end of December, again based on preliminary numbers from PitchBook.5 While progress has been made on curbing inflation, with both the ECB and BOE making numerous rate hikes, the larger picture is one of a Eurozone headed toward a slowdown. With bankruptcy filings up, credit growth decelerating, central banks retaining a bias toward tightening, and Purchasing Manager Indices (PMIs) contracting for both the manufacturing and services sectors, it’s no wonder that regional sentiment has been poor.6 While there is certainly significant dispersion across European economies, the weak momentum of the 2023 Eurozone market is likely to carry through much of 2024. Despite the gloomy regional macro outlook, 2023 did see a few major European buyouts, including the second largest globally.7

For Europe, 2023 was a year of instability. In regional private markets, deal counts declined 16% YoY, with deal value down 25% YoY through the end of December, again based on preliminary numbers from PitchBook.5 While progress has been made on curbing inflation, with both the ECB and BOE making numerous rate hikes, the larger picture is one of a Eurozone headed toward a slowdown. With bankruptcy filings up, credit growth decelerating, central banks retaining a bias toward tightening, and Purchasing Manager Indices (PMIs) contracting for both the manufacturing and services sectors, it’s no wonder that regional sentiment has been poor.6 While there is certainly significant dispersion across European economies, the weak momentum of the 2023 Eurozone market is likely to carry through much of 2024. Despite the gloomy regional macro outlook, 2023 did see a few major European buyouts, including the second largest globally.7 Market performance was varied across the region, with the focus shifting from China and with some bright spots emerging. For instance, APAC saw a decline in private market deal value by a 14%, and total deal count down 20% which, while still sharp, is slightly more moderate than other regions.8 Exits in the region remain challenging, with India being a bright spot as it was the lone market to see an increase in exits, while Australia and New Zealand saw some sizeable third quarter transactions.

Market performance was varied across the region, with the focus shifting from China and with some bright spots emerging. For instance, APAC saw a decline in private market deal value by a 14%, and total deal count down 20% which, while still sharp, is slightly more moderate than other regions.8 Exits in the region remain challenging, with India being a bright spot as it was the lone market to see an increase in exits, while Australia and New Zealand saw some sizeable third quarter transactions.