The Long View:

Don’t Get Lost in the Noise

If there is a word to describe the start of the new year, it would be volatility. From the new US administration’s string of executive orders, to rapidly evolving news stories on global AI disruptions, to regional economic moves from Argentina to the Bank of England and beyond, we knew this was coming: 2025 was never, ever going to be quiet.

Recently, American saber rattling about potential tariffs garnered international headlines. My belief is that, despite the rhetoric, the tactics, and the insatiable hunger for the headlines, as the largest economy in the world connected to our largest and entangled trade partners, tariffs of 25%, 60%, and 25% across the board are highly unlikely. They would disrupt supply chains, raise the risk of inflation, and potentially be very costly to all involved. The possibilities are endless, but tariffs at the levels being discussed if not threatened? Unlikely and ever changing.

But let’s not get lost in the noise, especially when there is so much of it. As private market investors, there are a few lessons we should all remind ourselves of.

In private markets, our investment success relies on innovation, entrepreneurship, professionalization, transformation, and value-added capital to drive efficiency and investment performance. Fortunately, these attributes tend to be longer-term persistent, regardless of which political party is in control. This falls more in line with Warren Buffett’s argument of relying heavily on the fundamentals and not the macro or geopolitical.

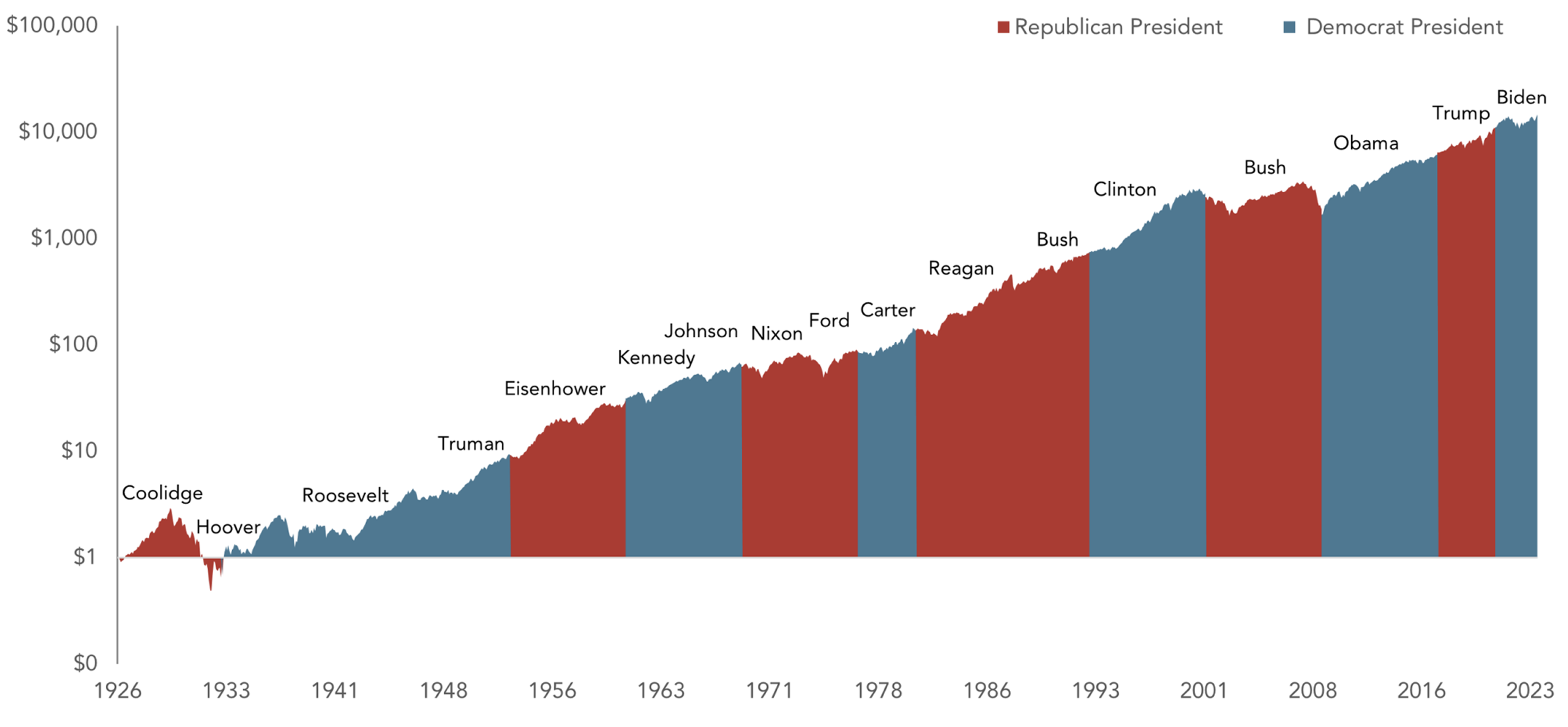

As a long-term asset class, we take comfort in knowing that historically the sitting President of the United States has not had a material effect on long-term US market performance, regardless of political party, as measured by the S&P 500. Our expectation is that this cycle will be no different.

Markets have rewarded long-term investors under a variety of US presidents

Growth of a dollar invested in the S&P 500: January 1926 - December 2022

Past performance is not a guarantee of future results. Indices are not available for direct investment: therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Data presented in the growth of $1 chart is hypothetical and assumes reinvestment of income and not transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment.

Source: S&P data C Down Jones Indices LLC, a division of S&P Global. All rights reserved.

Looking back over 15 years of data to 2008, we also know that private equity tends to be more resilient than public markets, as shown below. With the typical investments lasting four to six years, and often as long as a decade or more, our typical holding window exceeds that of a single US presidential administration, not to mention the numerous turnovers at 10 Downing St (e.g., Truss, Sunak, etc.) and elsewhere. During a single private market investment period, there can be various global up and down cycles which affords us the position of observing rather than reacting to these global macro events. And if an adjustment is warranted, given private market managers are active managers, we believe the best managers will be able to navigate times of volatility nimbly and gain market share.

Private equity tends to hold steady during public market swings

For illustrative purposes only.

Source: HarbourVest investment, monitoring, and due diligence activities. Not representative of any HarbourVest fund or account. Gross of management fees and carried interest. MSCI ACWI sourced from MSCI. Past performance is not a reliable indicator of future results.

Connect with HarbourVest

That said, in a generally illiquid long-term asset class we must acknowledge that political leadership can change the course of a country and economy for better or worse for a decade or more. It can also change the course of our global investment thesis. This used to be the case in tactical markets including Venezuela, Russia, and Argentina. Today it is just as relevant for North America, Europe, and China. We’ll have to watch these markets to see how they evolve. For instance, if imposed, tariffs would likely have regional sectoral impacts and so would unfold heterogeneously across local markets.

The Chinese lunar calendar recently changed, ushering in the year of the snake — a symbol of rebirth and regeneration. Let us hope that is true. But either way, as we navigate news cycles driven by tariffs, ByteDance and TikTok and other pressing issues, we should anticipate short term volatility in shorter term asset classes and what will sometimes feel like “chaos.”

In this context, we should welcome the fact that we are long-term investors in an asset class that largely mutes short-term volatility; an asset class underpinned by longer term fundamentals where the investment thesis is validated at the time of the final outcome.

HarbourVest Partners, LLC (“HarbourVest”) is a registered investment adviser under the Investment Advisers Act of 1940. This material is solely for informational purposes; the information should not be viewed as a current or past recommendation or an offer to sell or the solicitation to buy securities or adopt any investment strategy. In addition, the information contained in this document (i) may not be relied upon by any current or prospective investor and (ii) has not been prepared for marketing purposes. In all cases, interested parties should conduct their own investigation and analysis of the any information set forth herein and consult with their own advisors. HarbourVest has not acted in any investment advisory, brokerage or similar capacity by virtue of supplying this information. The opinions expressed herein represent the current, good faith views of the author(s) at the time of publication, are not definitive investment advice, and should not be relied upon as such. This material has been developed internally and/or obtained from sources believed to be reliable; however, HarbourVest does not guarantee the accuracy, adequacy or completeness of such information. The information is subject to change without notice and HarbourVest has no obligation to update you. There is no assurance that any events or projections will occur, and outcomes may be significantly different than the opinions shown here. This information, including any projections concerning financial market performance, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. The information contained herein must be kept strictly confidential and may not be reproduced or redistributed in any format without the express written approval of HarbourVest.