February 6, 2024 | 8 min read

In the second half of 2023, an elevated federal funds rate began to curb inflationary pressures which led to a more dovish tone from the Federal Reserve. While the Fed may look to cut interest rates in 2024, the market is expecting that base rates will remain elevated relative to what investors have grown accustomed to in the post Global Financial Crisis (GFC) era.

With that backdrop in place for the coming year, many allocators are asking what a higher-than-average interest rate outlook means for forward-looking returns across the private market landscape. To assist investors with that question, below we evaluate the potential return distributions of the private credit and private equity markets under a range of interest rate scenarios and discuss how allocators can begin taking advantage of opportunities, like those in the junior credit market, that are poised to benefit from the current interest rate environment.

The potential impact of a higher federal funds rate across the capital structure

The Secured Overnight Financing Rate (SOFR) is a broad measure of the cost of overnight borrowing/lending used by financial institutions and is heavily influenced by the federal funds rate set by the Federal Open Markets Committee (FOMC). The majority of private credit securities are priced at a spread to the 3-month SOFR, which means higher-than-average interest rates typically increase the return profile of private credit. But an elevated SOFR can also have an impact on the return outcomes for other private market strategies. For example, in the private equity market, higher interest rates can lead to higher debt financing costs that can weigh on financial returns.

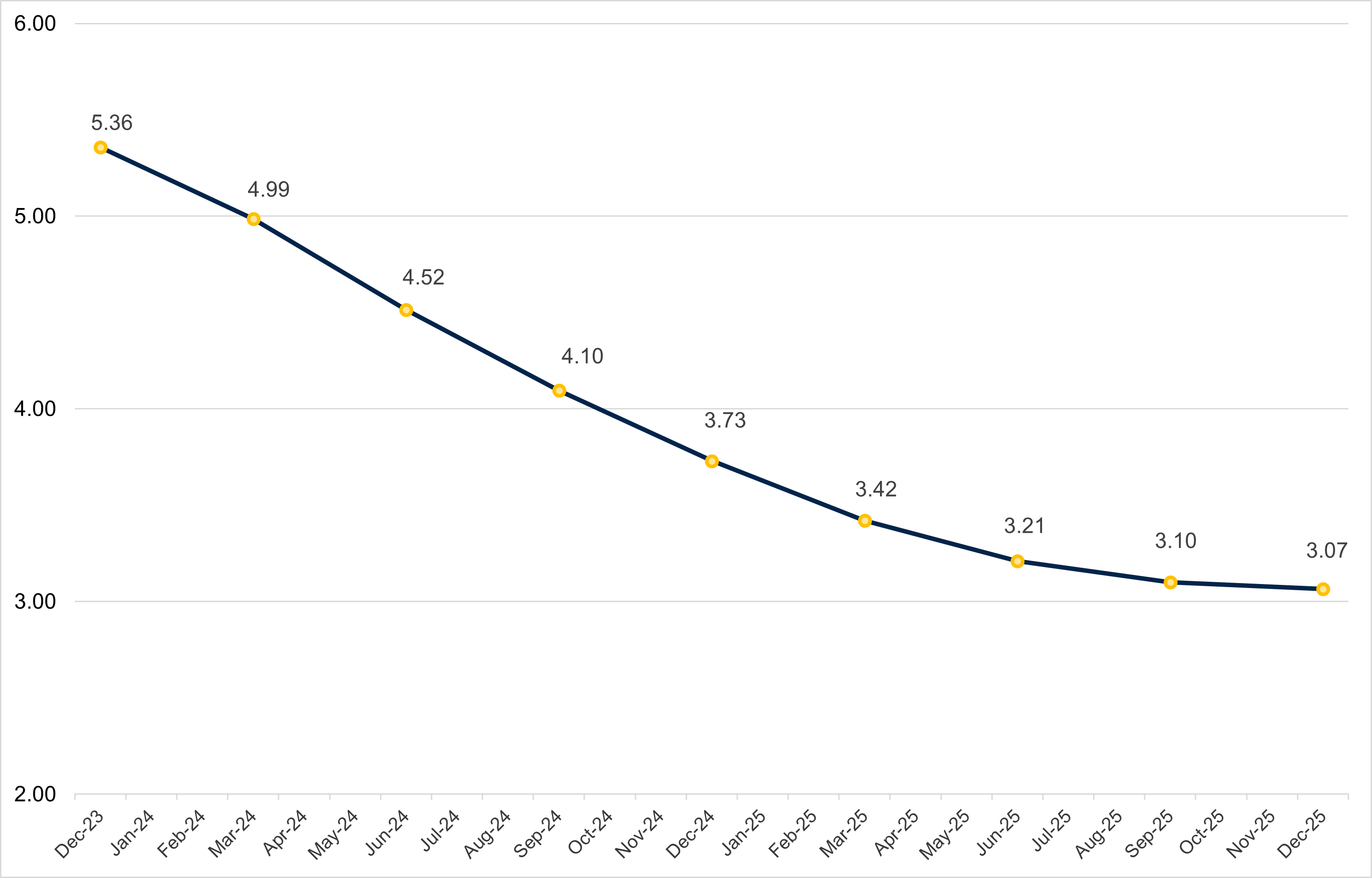

The chart below shows the forward SOFR curve from the end of 2023. Based on recent remarks from the Fed, it is conceivable that short-term interest rates will begin to fall in 2024 but will remain above post-GFC averages for the foreseeable future.

SOFR forward curve %

Source: Bloomberg, 3-month SOFR futures contracts as of December 31, 2023.

Allocators are asking: Why junior credit, why now?

The current market environment is producing yields in senior credit between 10%-12% and yields in junior credit between 14%-18%.1 Credit securities being issued in the current market also offer investors the following potential structural benefits:

- Seniority in the capital stack relative to equity

- Contractual returns with a fixed maturity/liquidity date that help eliminate valuation risk

- Quarterly cash interest payments or quarterly accretion for the PIK securities

- Better capital structure quality with less leverage and lower loan-to-value (LTV) metrics

- Operating experience in a post-COVID economy, reinforcing resiliency of business models

As allocators construct private credit portfolios, we are often asked why one should consider an allocation to junior credit, particularly if the senior credit market can achieve their return objective.

First, a portion of the junior market today is fixed rate versus floating rate. This can provide a hedge to the possibility of interest rates falling from current levels, which appears likely based on the forward SOFR curve. The junior credit market is also currently seeing strong lender protections in terms of non-call terms and pre-payment penalties that we believe will result in junior credits being outstanding longer than historical norms — potentially resulting in more attractive IRRs and money multiples. Finally, today’s junior credit market provides attractive relative value versus historical leverage levels, as the average investment is capitalized with less leverage than 12-18 months ago.2

To put today’s opportunity in perspective, investors can compare it to market conditions before the Fed started raising interest rates. During 2021, when SOFR was at 0.25%, senior credit was yielding 5%-7%, well below the return target for many private credit allocations. To help achieve their return objectives, many investors allocated to junior credit, which was pricing at 8%-11%.3 In this environment, companies were able to support a higher absolute level of leverage at nominal expense. But in the current environment, companies generally have less overall leverage due to higher interest expenses. At the same time, higher interest rates are driving substantially higher yields in junior credit. Hence, we think today’s market environment is an opportune time to be committing to junior credit because investors are securing higher returns in high-quality performing businesses (and not distressed non-performing businesses), at lower leverage levels than they were able to achieve in a lower interest rate environment.

Calibrating return expectations in a higher interest rate environment

For many allocators this will be their first time investing into a higher-than-average interest rate environment. Therefore, revisiting some of the drivers of different private market returns and illustrating how a higher rate environment may impact different segments of the market in different ways can be a valuable exercise.

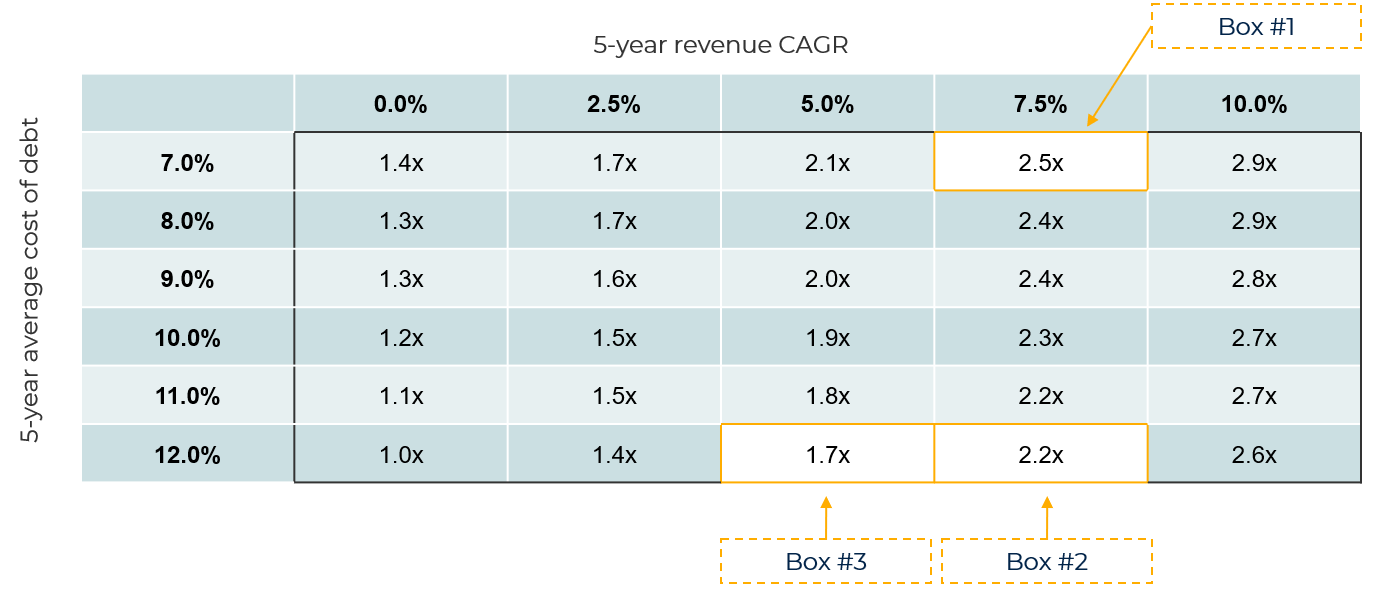

The table below shows five-year buyout equity returns on a money multiple basis, with returns sensitized by adjusting two variables:

- the average interest cost of the debt used to finance the acquisition over the life of the investment, and

- the revenue growth rate of the company over a five-year hold period.

In this simplified model, it is important to note that these are the only two variables that change. No assumptions or adjustments are made regarding entry/exit multiples, leverage levels, EBITDA margins, CAPEX, or taxes.

The impact of higher rates on buyout returns (MOIC)

Source: HarbourVest. Provided for illustrative purposes only. There is no guarantee that the portfolio construction discussed herein will achieve any stated goals. It is not intended to predict the performance or outcome of any future investment in the private equity industry.

There are several conclusions that can be drawn from this sensitivity analysis. Starting in the top right of the data table in Box #1, an investor could have expected to realize a 2.5x money multiple (gross) with revenue growth forecasted at 7.5% per year and a 7% average cost of debt over the investment’s life. This scenario reflects the market environment in 2021, when SOFR was at 0.25% and the average cost of debt (accounting for a senior and junior tranche) was approximately 7% for the average buyout deal.

Fast forward two years and the Fed has increased the fed funds rate by more than 5% to the 5.25%-5.50% range. Assuming the same 7.5% revenue growth and increasing the cost of debt from 7% to 12%, Box #2 shows that the expected return decreases to a 2.2x multiple on invested capital (MOIC). While this still represents an attractive return profile, it is lower than what might have been expected in a lower rate/higher growth environment.

Other important variables that influence buyout returns are also subject to change in a higher interest rate environment. For example, overall leverage will likely decrease due to higher interest expense. Additionally, revenue growth could decrease, driven by the fact that more of a company’s free cash flow is used to pay interest expense, leaving less cash flow after interest to invest in growth initiatives such as acquisitions, or investing in sales or research and development.

Therefore, when returning to the simple model and assuming revenue growth drops from 7.5% to 5%, Box #3 shows that the expected return drops to a 1.7x MOIC.

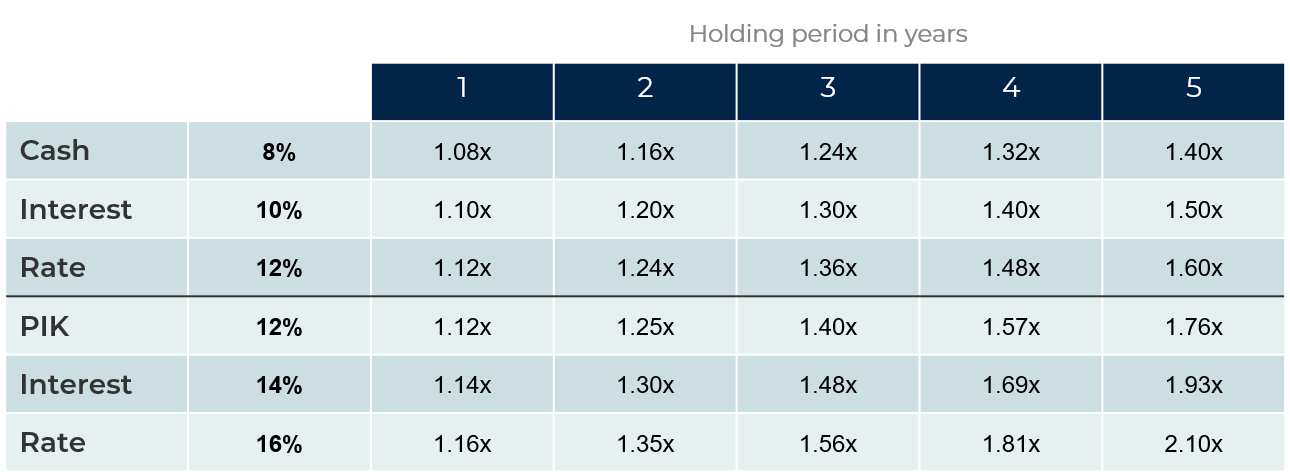

Comparing these returns to the credit returns illustrated below, not surprisingly, a higher interest rate environment causes the two to converge. Below are simple money multiple returns over various holding periods at different rates for a cash pay credit security and a paid-in-kind (PIK) security. It is interesting to note that today’s PIK securities, which often incorporate meaningful non-call features and pre-payment penalties are providing money multiple returns that can be comparable to equity buyout returns.

Impact of higher rates on credit returns (MOIC)

Source: HarbourVest. Provided for illustrative purposes only. There is no guarantee that the portfolio construction discussed herein will achieve any stated goals. It is not intended to predict the performance or outcome of any future investment in the private credit industry.

Implications for portfolio construction

While returns of the broad private equity universe may face some headwinds in a higher rate environment, we believe that top managers focused on businesses with resilient cashflows and clear valuation creation strategies can continue to generate attractive returns, as opposed to those who rely more heavily on financial leverage to drive returns.

That said, given the importance of interest rates on buyout returns, we believe it is prudent for allocators to revisit some of the return expectations that have been adopted in the lower interest rate environment that followed the GFC. With rates at a 23-year high and uncertainty as to where they will go from here, we believe there is a compelling opportunity to diversify a traditional buyout allocation with an allocation to junior credit that is benefiting from the current interest rate environment. In doing so, allocators can also potentially realize several other structural benefits afforded by the credit markets, including contractual returns, quarterly distributions, and downside protection afforded by the seniority of credit over equity in the capital stack.

Would you like to discuss private credit investing?

-

- Refinitiv, as of September 30, 2023.

- HarbourVest, as of November 30, 2023.

- HarbourVest, as of December 2021.

HarbourVest Partners, LLC is a registered investment adviser under the Investment Advisers Act of 1940. This material is solely for informational purposes and should not be viewed as a current or past recommendation or an offer to sell or the solicitation to buy securities or adopt any investment strategy. The opinions expressed herein represent the current, good faith views of the author(s) at the time of publication, are not definitive investment advice, and should not be relied upon as such. This material has been developed internally and/or obtained from sources believed to be reliable; however, HarbourVest does not guarantee the accuracy, adequacy or completeness of such information. There is no assurance that any events or projections will occur, and outcomes may be significantly different than the opinions shown here. This information, including any projections concerning financial market performance, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. The information contained herein must be kept strictly confidential and may not be reproduced or redistributed in any format without the express written approval of HarbourVest.

More HarbourVest insights

10 Deals that Defined Private Markets in 2025