Diversification does not ensure a profit or protect against a loss.

This material is solely for informational purposes and should not be viewed as a current or past recommendation or an offer to sell or the solicitation to buy securities or adopt any investment strategy. The opinions expressed herein represent the current, good faith views of the author(s) at the time of publication, are not definitive investment advice, and should not be relied upon as such. This material has been developed internally and/or obtained from sources believed to be reliable; however, HarbourVest does not guarantee the accuracy, adequacy or completeness of such information. There is no assurance that any events or projections will occur, and outcomes may be significantly different than the opinions shown here. This information, including any projections concerning financial market performance, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.

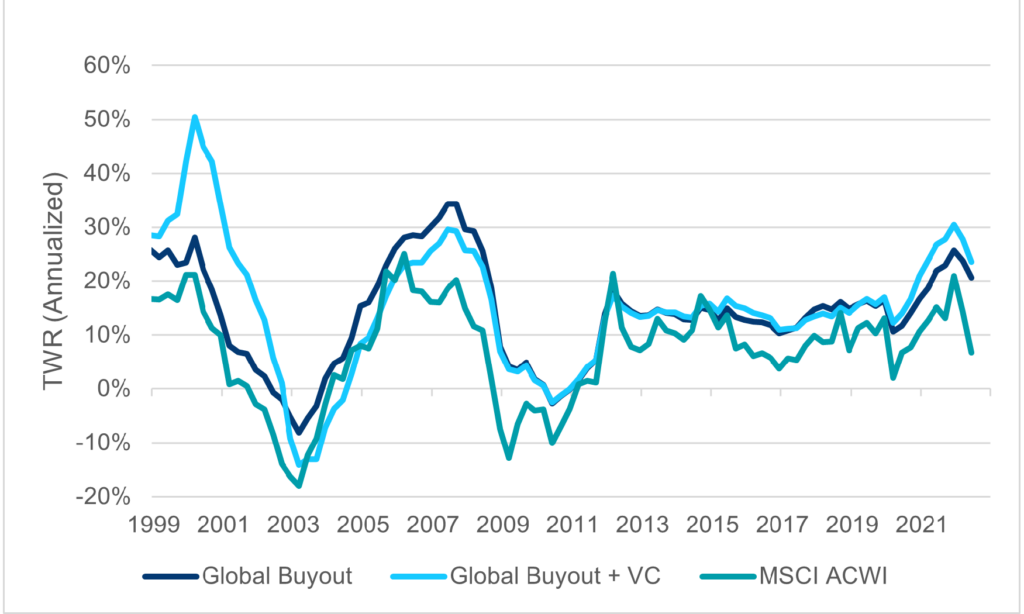

The MSCI AC World Index (ACWI) is designed to measure the performance of publicly-traded large and mid-capitalization equity securities in global developed and emerging markets. The MSCI ACWI Index is maintained by Morgan Stanley Capital International (“MSCI”) and has historically captured approximately 85% coverage of the free float-adjusted market capitalization of its publicly-traded global equity opportunity set.

Private Equity Index Data: Unless otherwise indicated, all private equity fund benchmark data reflects the fees, carried interest, and other expenses of the funds included in the benchmark. Burgiss (unless otherwise noted) is the source and owner of any private equity index data contained or reflected in this material and all trademarks and copyrights related thereto.