Don’t Miss the Middle: The Outperformance of

Mid-Market European Private Equity

as featured in Invest Europe

May 30, 2024

Having made our first buyout fund investment in Europe in 1984, we at HarbourVest have seen the European private equity market evolve over the past four decades. With the development of the asset class, we believe the mid-market offers a compelling set of opportunities in Europe over coming cycles.

Twenty to thirty years ago, the PE landscape in Europe looked markedly different. The whole industry raised between €25bn-€40bn of funds to invest largely in buyouts across Europe and the average fund size was around €200m. The mid-market buyout universe largely consisted of generalist funds that focused on a single country or a small region and whose value creation models consisted largely of buying at attractive valuations, injecting leverage into the business and enhancing the governance and reporting systems. A major source of return was therefore the unlocking of deals through local networks and then the multiple arbitrage gained through scaling of the business.

As an Invest Europe member, we have observed that a few decades on, mid-market managers have a value creation toolkit that includes multiple sophisticated tools to create value for investors. Today, European private equity represents a vibrant landscape of seasoned managers with strong operational capabilities. They benefit from a diverse and sizeable market of private companies, with experienced management teams and access to functioning capital markets. Mid-market managers have refined their sourcing approach and built up both their operational teams and capital markets capabilities to support companies in their growth as well as enhanced digital capabilities for identifying opportunities. They also have better access to experienced management teams, and an ability to build value in a measured and considered way at a time when the market environment is uncertain.

In recent years we have observed more mid-market funds emerge that are pan-European and focused on one or two sectors, including healthcare, technology, business services, and/or financial services. The mid-market allows for greater opportunity to access more sector specialization. Existing generalist mid-cap funds have become more focused on fewer sector verticals where they have demonstrated expertise and a compelling track record. Many PE mid-market managers have moved away from capital intensive businesses or those overly exposed to the consumer sector and exploring growth through digitalization. Industrial based economies like Germany, for example, are ripe for technological disruption where technology can be leveraged to bring those industries to the forefront for the next cycle.

By its nature, Europe remains a highly fragmented market with significant opportunity for mid-market managers to consolidate companies as they build their positioning in their respective geographies or industries. Consolidation allows companies to expand across the region, adapting products and services for other local markets, or leading consolidation in fragmented industries. It is also a great way for managers to reduce risk in a portfolio as add-ons are completed across a longer period of time – and typically at lower entry prices than platforms. Mid-market strategies, particularly at the lower end, tend to not rely on leverage as a source of value creation which means that in today’s uncertain environment managers can continue to make investments even on an equity-only basis. Today there is also a vibrant private debt market willing to support businesses at points in the cycle when banks may not be as active.

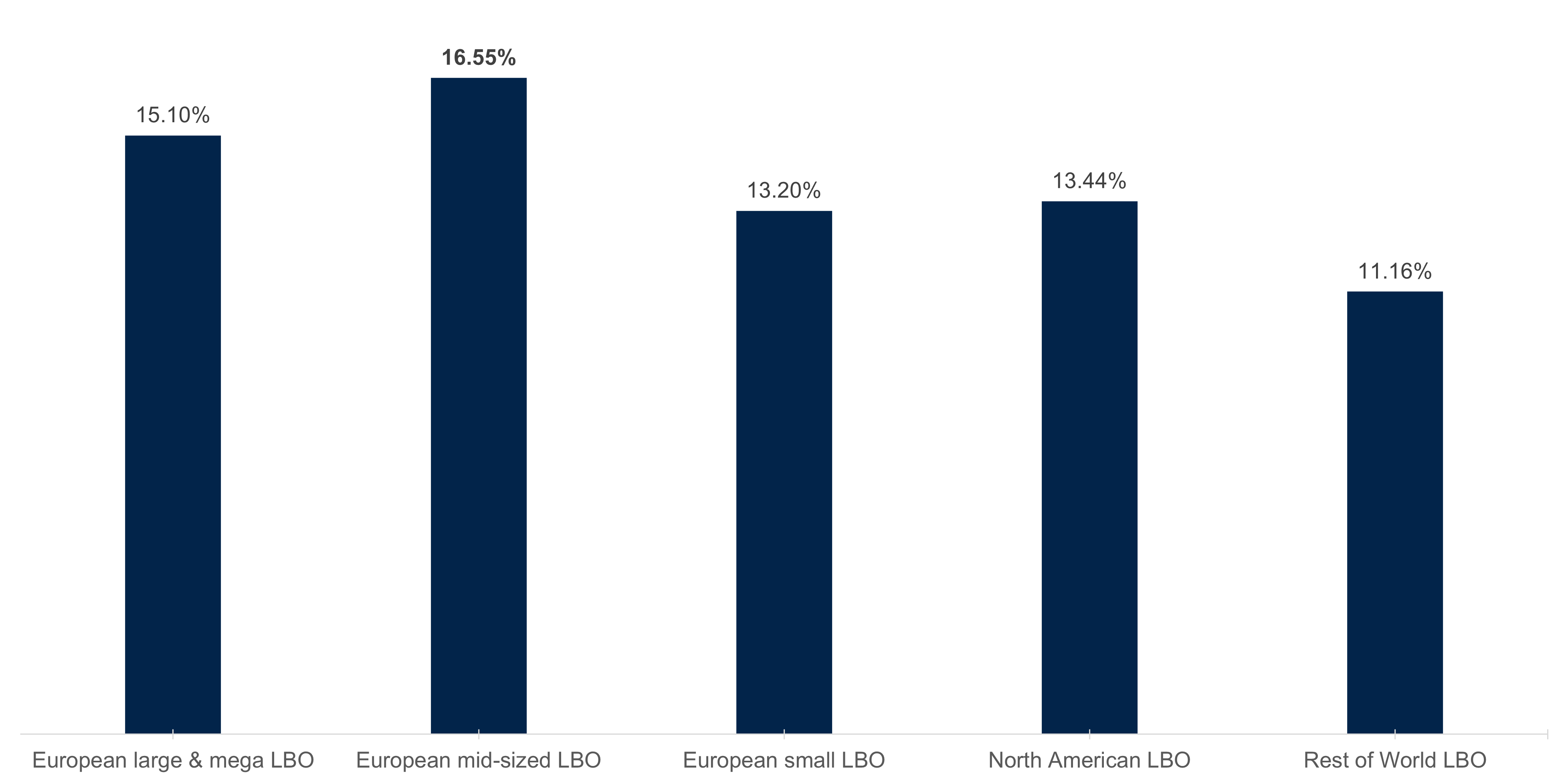

As a result of all of the above, the mid-market has demonstrated persistent outperformance. Over the past 35 years, European mid-sized buyout funds have delivered a net IRR of 16.6% — a rate that is higher than all segments in Europe as well as large buyout globally. In the past decade alone, the investment by mid-market managers in European businesses has more than tripled and the number of companies supported has doubled. In the end, the mid-market has remained the core engine of the private equity market in Europe and has scaled significantly.

Net IRR of LBO funds

By size and geography

Source: ‘Mid-Market Private Equity, Europe’s Engine for Growth’, Invest Europe, based on Cambridge Associates

While Europe has never been a story of macro growth and will most likely continue to present political risks, we are nevertheless excited about the investment opportunities we see in Europe given the combination of a structural opportunity with a maturing experienced manager landscape and a history of consistent outperformance to public benchmarks. As we look ahead, we believe long-term secular growth trends including digitalisation, decarbonisation, and demographic shifts will benefit the Europe private equity market. After all, we believe there’s nothing middling about the European mid-market.

Would you like to learn more about private markets investing?

This material is solely for informational purposes and should not be viewed as a current or past recommendation or an offer to sell or the solicitation to buy securities or adopt any investment strategy. The opinions expressed herein represent the current, good faith views of the author(s) at the time of publication, are not definitive investment advice, and should not be relied upon as such. This material has been developed internally and/or obtained from sources believed to be reliable; however, HarbourVest does not guarantee the accuracy, adequacy or completeness of such information. There is no assurance that any events or projections will occur, and outcomes may be significantly different than the opinions shown here. This information, including any projections concerning financial market performance, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.

More from HarbourVest

Insights

What is Venture? An Interstellar Journey Toward a New Definition