August 16, 2023 | 15 min read

Current macroeconomic challenges impacting global financial markets have created an atmosphere of slower, more targeted private capital deployment. Yet, having experienced incredible returns over the last 10 years,1 venture capital continues to offer investors ample opportunity for outperformance relative to both public market equivalents and other private markets sub-asset classes.2

Four regional leaders from HarbourVest’s global Primary Investment team share their insights on the current state of venture capital, why investment in venture remains vibrant despite market volatility, and where opportunities in venture capital lie going forward. Read below to see where they believe the innovation cycle is taking venture capital in 2023 and beyond.

Q What have you been seeing broadly in terms of venture valuations?

Scott Voss (US): Private markets typically mute and lag public markets, and when there is unusually high volatility with short term swings it is difficult to anchor on true fair market value. Many of the markdowns that we saw in 2022 were a result of public positions connected to recent IPO activity trading down significantly (a true mark-to-market based on public market value at quarter end). On the private side, we saw managers proactively make valuation adjustments that were reflective of the public market correction. To date, there have not been many down rounds; write downs have been proactive with managers driven by public market comp adjustments. So, while private markets took a more gradual and muted path relative to public markets, as is typical, we saw NAV declines during 2022 ranging from -10% to -30% depending on the stage and maturity of investments.

There was also less consistency in managers’ approaches to this private company mark-to-market exercise. Because many venture-backed companies raised large rounds of financing pre-correction and then reduced cash burn to extend their cash runway post correction, they have not had to return to the private markets to raise subsequent capital and test their current private market valuations. We think 2024 will be a big year for companies going back out to the market to raise their next round and this will test the legitimacy of current carrying values.

Amanda Outerbridge (US): With continued public market volatility, there is an uncertainty that hangs over valuations in 2023. Fundamentals have always been important, but over the last few years we have seen returns generated from hypergrowth companies where the path to profitability was far into the future. Today, there has been a shift away from “growth at all costs” and a heightened focus on viable, disciplined business models that can achieve profitability in the medium/near term.

Late-stage venture capital and growth equity have been most impacted by re-ratings in valuations as public market comparables impact this end of the market more than early-stage and seed. As later stage activity has declined, managers have become increasingly active at the earlier end of the market. Early stage valuations have remained more stable and seed valuations have modestly risen. We believe the early stages continue to offer attractive entry points for investors where they can access the next generation of category leaders and gain high ownership to drive outsized returns.

Alex Wolf (Europe): The valuation environment in Europe is similar to what Scott and Amanda described in the US. European venture managers are adapting their valuation methodology to today’s market and in many cases are taking discretionary mark-downs from the last round valuation to reflect company performance and reduced multiples for comparable businesses. Thus, in Europe we have seen very few down rounds to date.

That said, we have seen some contrast in the valuation picture. There are some exceptional companies that are earlier stage growth businesses raising money at higher valuations than their last round of funding, despite the challenging environment.

Lydia Hao (Asia): Venture valuations in Asia took a similar path as their global counterparts. However, the magnitude of adjustments, both on the up and the down, have been lower. Compared to US and European venture markets, venture-backed companies in Asia saw more muted valuation uplifts during 2020-2021, resulting in less adjustment in 2022 and into 2023. Meanwhile, many businesses are aggressively reducing cash burn and focusing on unit economics to weather the current pullback in venture funding. For those companies that must return to market, we often hear “flat round is the new up round” and new investors are able to secure more favorable deal terms.

Despite the pressure on valuations, many late-stage companies in Asia continue to deliver strong organic growth and improving operating metrics, demonstrating the resilience of founders and the attractive market fundamentals more broadly across Asia.

Q Why is now a good time to invest in venture?

Alex Wolf: Two words: innovation cycles. Innovation equals new company creation – the lifeblood of the venture industry. While macro headwinds do pose a challenge in the short term for the funding and financing of venture portfolio companies, the long-term outcome of truly great businesses is less impacted by these factors. For example, Airbnb, Slack, Instagram, Wise, and Farfetch were all conceived during times of macro headwinds, yet they represent some of the most successful venture-backed companies ever created. Fundamentally, when companies are built to disrupt incumbents and incumbent business models with a focus on “better, faster, and cheaper,” they are less impacted by macroeconomic factors.

We believe the current macro uncertainty creates a healthy consolidation across all stakeholders in the venture capital value chain – including entrepreneurs, portfolio companies, and managers – because it eliminates the “tourists.” Only the strongest companies will survive when capital is less abundant and there is more time for due diligence (as fundraising and investment pacing return to more normalized levels). Venture capital remains the most effective way to access future market leaders, and the current choppy market environment is setting up the next wave of venture disruption.

Innovation cycles provide opportunities uncorrelated to market cycles

Source: HarbourVest Partners. For illustrative purposes only.

Lydia Hao: The previous innovation cycle in Asia gave rise to many highly recognizable venture-backed consumer internet platforms across markets. The existing infrastructure has matured, acting as a multiplier for next generation ideas, bringing about both vertical specialization and horizontal integrations. This is driving the next cycle of innovation which we believe will be broader across a different set of sectors in Asia, such as software services, biotechnology, advanced manufacturing, and energy transition.

From an asset allocation perspective, this is also an opportune time to consider Asia venture as the relative bargaining power has shifted from GPs to LPs, and we are seeing several LP-favorable dynamics that had not existed before, including:

- Previously access-constrained managers are more open to engaging with new LPs as the overall fundraising environment becomes tougher, putting LPs in a prime position to demand better terms.

- Managers are engaging in deeper dialogues with LPs and allowing more time and a greater degree of access during due diligence.

- GPs are going back to basics and rethinking the appropriate fund size and team capabilities to execute on the new sector opportunities.

These factors are further enhanced by the significant corrections in entry valuations across sectors, given lower levels of competition among venture capitalists for deal allocation. Again, in times of market dislocation and uncertainty, we believe these conditions can be true tests of founders’ grit and conviction behind their next big ideas.

Scott Voss: It really is all about the innovation cycle. Two innovations that have driven venture returns over the last 15 years are the creation of the iPhone and the shift to the cloud in the enterprise software space. The introduction and broad adoption of the iPhone put a computer in each of our hands and forever changed the way we access information, communicate with each other, and function as consumers. Some of the most notable venture-backed outcomes of the last decade are apps that live on our phone (think Google, Facebook, Uber, and others).

Similarly, the migration to a cloud-based subscription model has forever changed the software industry. Cloud infrastructure built by Amazon AWS, Microsoft Azure, and Alibaba Cloud has facilitated business model innovation in the enterprise software space, moving leading software providers off premise and migrating expensive licensing pricing models to pay as you go SaaS models. This innovation has taken friction and expense out of the purchase decision, allowing for broad adoption. The resulting mission critical software solutions have blossomed into very successful venture-backed companies (including Salesforce, Workday, and Zoom).

Innovation cycles that we are excited about looking forward include AI, cybersecurity, and regenerative medicine, to name a few. We believe it is possible that these themes will have market defining impacts on the venture industry, similar to the iPhone and cloud.

Q Where is venture headed in 2023 and beyond?

Amanda Outerbridge: Change creates the opportunity to reimagine, improve, and disrupt. There are a number of future areas of disruption that are showing promising signs of growth and transformation in durable segments today. There is significant excitement around artificial intelligence right now, and a question we often receive is whether there is real value there or if it’s just another fad. We view the recent technology breakthroughs within AI as creating fundamental, lasting value that provides an expansive and growing opportunity set. Two of the reasons we believe this are the dramatically reduced costs of modeling and the rapid adoption of AI products.

Like other nascent technologies, the key is being able to work with managers that have been early leaders in AI who can weed through the hype and the noise to find the next-gen leaders across these disruptive technologies. Within AI, there are three broad categories where venture capitalists are investing:

- Core AI – which includes foundation models and supporting infrastructure for the AI ecosystem.

- Horizontal AI – applications which provide functional tools that are applicable across end markets.

- Vertical AI – applications with specific use cases across areas like sales and marketing, legal tech, health tech, and life sciences.

When you have new, big, emerging technology platforms, they can catalyze the ascension of technology hubs. For example, we have seen this across North America in Silicon Valley, Boston, and New York and are seeing it more recently in Toronto and Montreal.

Venture managers also continue to invest in cybersecurity, where constant innovation is needed to combat new vulnerabilities. Healthcare continues to be a durable sector where we see GPs investing in technologies, tools, and services to reduce costs, improve the patient experience, and support healthcare workers. The biotech revolution marches on with new methods of drug discovery and precision medicine. Fintech is another expanding market segment, and we continue to see strength in financial infrastructure, which is an area that is more mature along with new areas like decentralized finance and blockchain.

Lydia Hao: Asia is home to the second largest venture capital ecosystem globally after the US, with more than 400 unicorns spread across core markets of China, India, and Southeast Asia.5 In recent years, we have been closely observing Asia-focused managers evolve and build on their sector capabilities to capture next-gen sector leaders in:

- eCommerce and fintech – following the success of China’s consumer internet platforms built over the last cycle, we are seeing a rise in new business models across similar sectors in India and Southeast Asia as rising incomes levels continue to drive consumption upgrades in these markets.

- SaaS – this ecosystem in India is now a global leader, second only to the US in scale and maturity6 and caters to global clients. Meanwhile, enterprise software adoption in Japan is rapidly increasing as corporations look to improve process efficiency and data sophistication in different industries.

- Biotechnology – for the first time, China is beginning to lead best-in-class and global first-in-class drug discovery. This is gaining traction as evidenced by the increasing number of out-licensing deals done with multinational pharma companies in recent years.

- Robotics and energy transition – industrial robots and automated solutions have become essential in advanced manufacturing and modern logistics across many parts of Asia. The advancements in hardware technology are also enabling electrification and decarbonization solutions that fulfill increasing green energy demands. We know that Asia is already home to some of the world’s most advanced battery technology and wind turbine manufacturers.7, 8

Last but not least, we are equally excited about the field of generative AI across Asia, which could have far-reaching impacts that intersect all of the sector themes discussed above. When it comes to China, however, investors do need to navigate more geopolitical complexities. In August 2023, the Biden Administration unveiled an Executive Order aimed at restricting US outbound investments in a narrow set of advanced technology sectors in China (such as advanced semiconductors, quantum computing and artificial intelligence). Though this action was widely expected by the industry, we will continue to actively monitor the development of more detailed rules and assess their potential impact.

The long-term growth drivers for Asia’s venture opportunity set remain strong and we believe technology-driven solutions will continue to transform both consumer and enterprise-facing businesses uniquely tailored to Asian demands.

Alex Wolf: Europe continues to embed its position as a globally important center for innovation and entrepreneurship, with a positively reinforcing ecosystem of government sponsorship, repeat founders, and an increasingly distributed track record of success across the European continent. What is unique to Europe is that there is no Silicon Valley equivalent, so innovation and company creation has fanned out across the continent. We have now seen tech start-ups with assets greater than $1 billion founded in more than 50 cities across Europe.3 These large, category-defining companies are producing a strong supply of repeat founders and ex-operators, which makes for a higher quality entrepreneurial base than we’ve ever had in Europe. As an example, we’ve now seen more than 30 start-ups created by ex-employees from Spotify alone.4

The size, quality, and dispersion of the market opportunity in Europe also means that top tier global venture firms are feeling the need to establish a physical presence in Europe. We’ve seen this come to pass over the last few years with firms like Sequoia, General Catalyst, and Bessemer. Most recently, Andreesen Horowitz announced plans to open a London office.

Generative AI is clearly a key investment theme going forward in Europe, building on several years of investment into AI and machine learning given the strong engineering and technical talent base available in Europe. Europe also continues to lead the way in climate tech, sustainability, and purpose-driven investment themes such as:

- Carbon capture and sequestration, or blue and green hydrogen development,

- Consumer durables in the form of more sustainable products and packaging,

- Fintech relating to carbon credit-linked financing, and

- Ag-tech and alternative proteins or plant-based solutions.

Key Takeaways

- New company creation remains active across the globe despite the overhang of economic and geopolitical uncertainty.

- Venture capital, by investing in both intellectual property and business model innovation, can provide investors access to the future market leaders being created today.

- Venture managers are being more disciplined around valuations, and continued valuation adjustments create more attractive entry points for the asset class.

The entrepreneurship and disruption that has fueled venture capital since it became an institutional asset class over 70 years ago persists today. As new innovation cycles emerge, upper quartile venture capital is poised to continue to lead the way in private market performance, presenting investors an opportunity to achieve very strong returns.

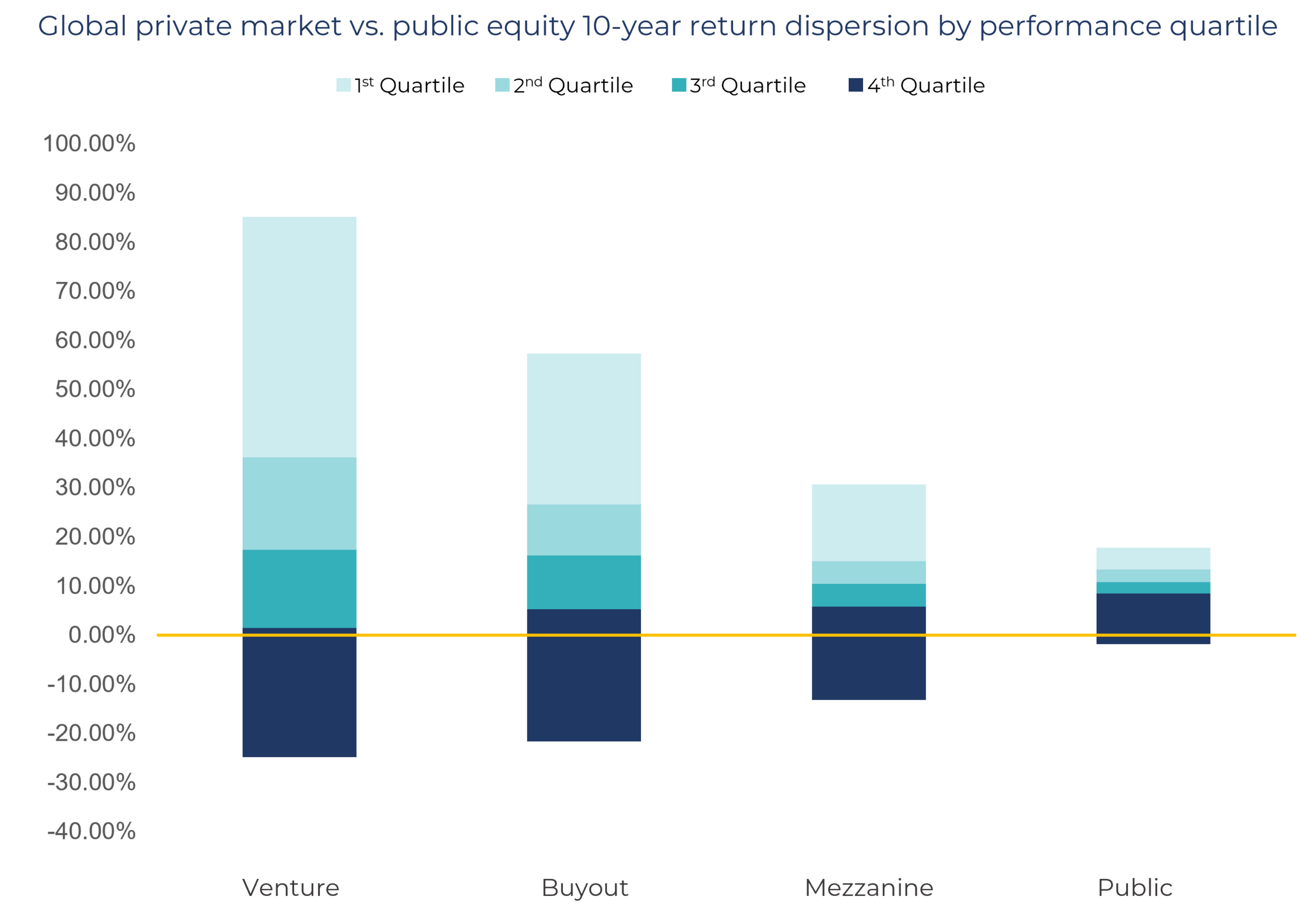

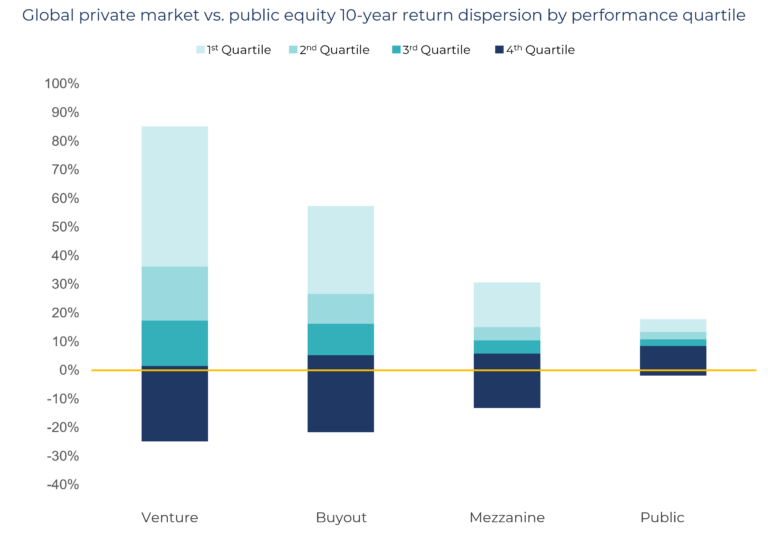

Return dispersion is significantly greater in private markets

Source: Burgiss, Bloomberg, HarbourVest as December 31, 2021. Returns are 10-year IRRs for private assets and 10-year annualized compound returns for public market assets. Public Equity reflects Bloomberg universe of 223 US-registered global equity mutual funds. Past performance is not a reliable indicator of future results.

As always, skillful manager selection is critical to maximizing expected returns of a private market portfolio – and access to top managers is especially important for venture capital, which tends to have a wider return dispersion than other private market segments and public markets.

Would you like to discuss current opportunities in venture capital?

- Burgiss, data as of 12/31/2022.

- Burgiss, S&P 500, MSCI ACWI, data as of 12/31/2022.

- Source: Accel, Europe and Israel’s startup founder factories and the founder journey, May 2023.

- Source: Accel, Europe and Israel’s startup founder factories and the founder journey, May 2023.

- Source: HarbourVest, based on data from Crunchbase, International Monetary Fund, and World Economic Outlook Database, April 2023.

- Source: Bain & Company, India SaaS Report 2022, January 23, 2023.

- Source: SNE Research, Global Top 10 Battery Makers’ Sales Performance in 2022, March 27, 2023.

- Source: Bloomberg NEF, Goldwind and Vestas in Photo Finish for Top Spot as Global Wind Power Additions Fall, March 23, 2023.

This material is solely for informational purposes and should not be viewed as a current or past recommendation or an offer to sell or the solicitation to buy securities or adopt any investment strategy. The opinions expressed herein represent the current, good faith views of the author(s) at the time of publication, are not definitive investment advice, and should not be relied upon as such. This material has been developed internally and/or obtained from sources believed to be reliable; however, HarbourVest does not guarantee the accuracy, adequacy or completeness of such information. There is no assurance that any events or projections will occur, and outcomes may be significantly different than the opinions shown here. This information, including any projections concerning financial market performance, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.

More HarbourVest insights

How does the size of private markets compare to public markets?