December 10, 2024 | 14 min read

As we move into 2025, headwinds are finally giving way to fair winds across private markets. With a gradual lowering of interest rates and a busy global election year now behind us, buyer and seller price expectations are starting to converge. The narrowing of this gap is a much-awaited catalyst that is helping unlock much-needed exit activity and dealmaking, providing limited partners (LPs) with the liquidity they need to rebalance their portfolios or invest in new funds. Alongside these trends, certain bright spots have continued to shine. Secondaries and continuation funds have been in high demand from both LPs and general partners (GPs) looking to release capital from their portfolios, while private credit has benefited from higher interest rates and borrowers’ need for flexible and tailored forms of financing available through private markets. When all of these pieces slot together, we believe that global private markets investors will continue to benefit from gathering global fair winds.

A warming, steady breeze on global markets

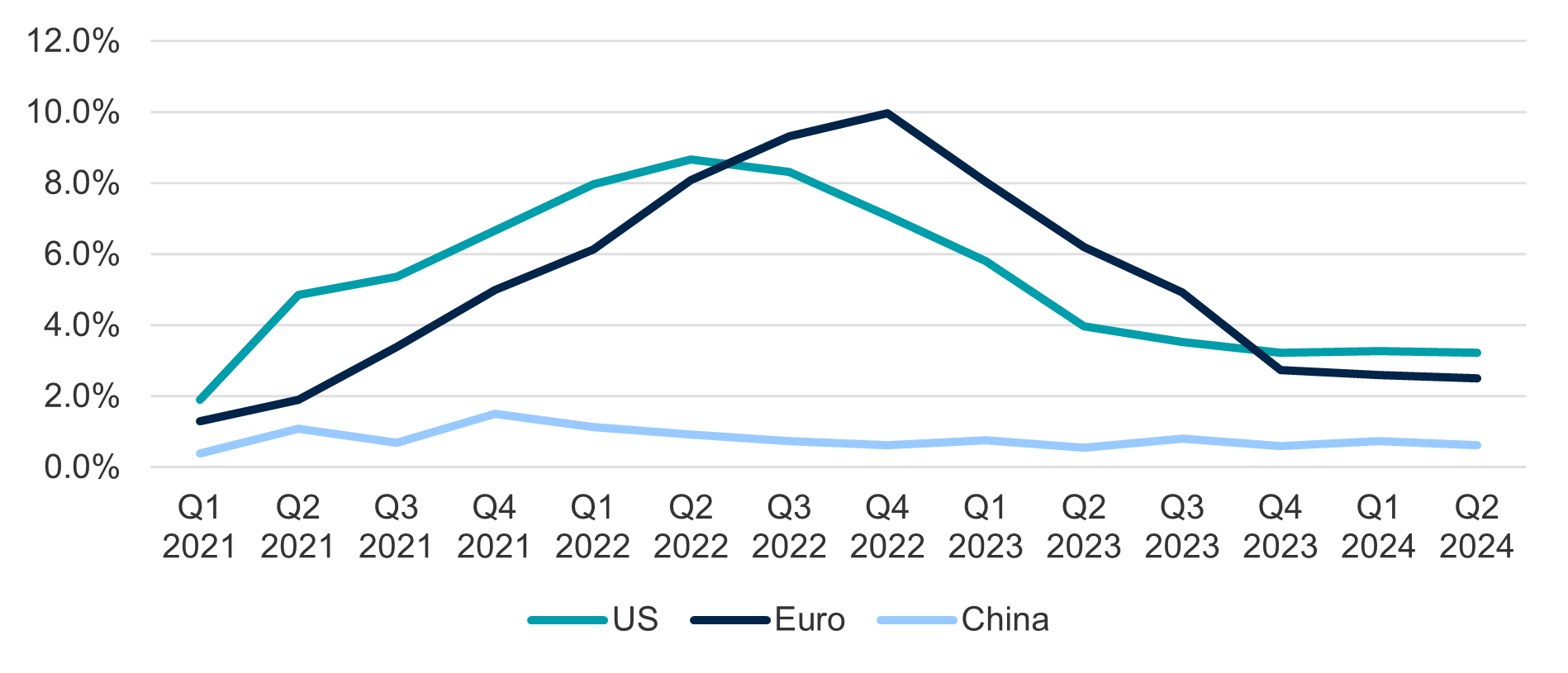

After more than two years, the macro backdrop appears to be reaching a steadier state. In 2024, central banks in several key Western economies started reducing interest rates — albeit gradually — as inflation moderated. Faced with marginally lower inflationary pressures, both the European Central Bank (ECB) and the Federal Reserve have made 0.75% cuts so far this year.

Inflation has moderated

Source: FRED, Trading Economics; as of September 30, 2024.

And yet, with geopolitical conflicts continuing to loom large on the world stage, global central banks remain on high alert as inflationary risk has far from disappeared. Investors appear to have put aside the false hopes of big rate reductions that many had this time last year and accepted a so-called new normal elevated neutral rate. Accordingly, public markets have had a strong 2024, with most indices worldwide notching up at least double-digit rises through the year.

In private markets, dealmaking confidence has started to return. After a tepid start, global private equity investment activity warmed up as mergers and acquisitions (M&A) more broadly started coming back to life. By Q3 2024, global M&A markets were up 28% by value and 13% by volume against the first nine months of 2023, with private equity’s share rising as 2024 progressed.1 The net result is that, at a value of $1.3 trillion, private equity investment activity in the first three quarters of 2024 was up 30% on the same period in 2023 ($1 trillion) and was the third highest deal value for the first three quarters of a year on record.2 Perhaps more importantly, as 2024 continues playing out, the valuation gap between buyers and sellers is continuing to narrow and we see the path clearing for a further pick-up in deal activity in 2025.

Global PE activity by quarter

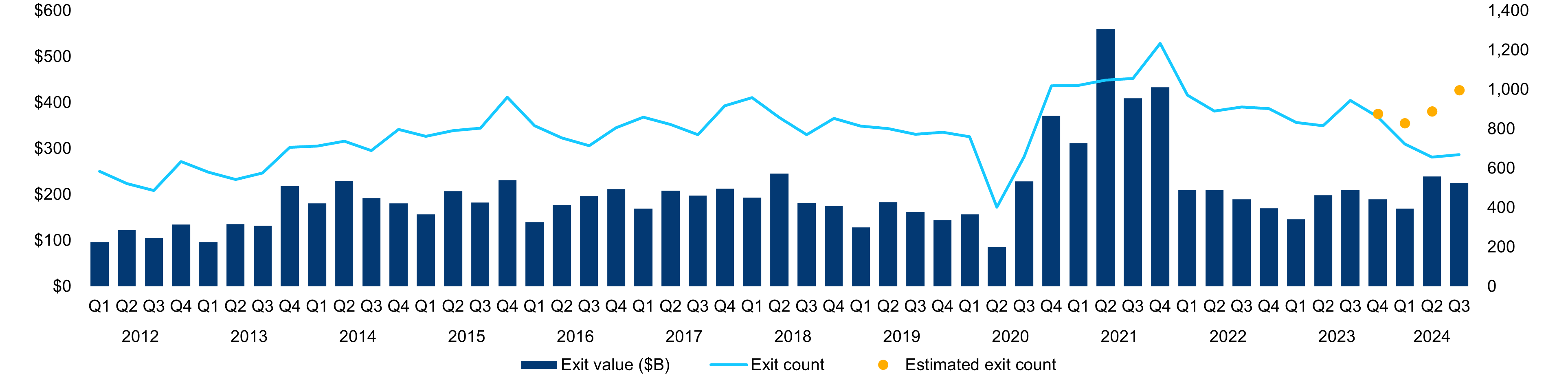

On the flip side, exits have yet to make a meaningful enough recovery to ease liquidity pressures for LPs, although 2024 did show some signs of promise as values improved through the year. While some way off the 2021 peak — which saw $1.71 trillion of private equity realizations globally — at $634 billion, the first three quarters of 2024 were comfortably ahead of the $555 billion recorded for the same period in 2023.3 A narrowing of the bid-ask spread appears to be providing support and bringing dealmakers back to the table.

Global PE exits by quarter

Regional updates

North America: Readying for regime change

It will take some time for the dust to settle, but it seems likely that some of the activity that was waiting on the sidelines ahead of the US presidential election result may start to come through by the end of 2024 and early into 2025. Private equity dealmaking had already started dusting itself off, with quarter-on-quarter rises and a third quarter total of $650 billion, up 23% by value and 13% by count on the first three quarters of 2023.5 Supporting this upturn in 2024 has been a more competitive debt financing backdrop as banks returned to the broadly syndicated loan market.

US PE deal activity by quarter

While already ahead of full-year 2023 values, US private equity exit activity in the first three quarters of 2024 remained muted compared with the sizeable inventory of buyout portfolio companies that have yet to be realized (which stood at $3.2 trillion globally in early 2024).6 By value, private equity exits stood at $303 billion through September 30, 2024, versus $281 billion for the whole of 2023. Although far from a listing rush, private equity managers were able to take advantage of strong public markets, with $25.6 billion of exits via initial public offerings (IPOs) through the third quarter of 2024, up from $8.6 billion during the whole of 2023.7 Encouragingly for future IPOs, after-market performance has been promising for these deals, with the median return for the 2024 sponsor-backed IPOs coming in at 43.9% and the average logging in at 29.7% at the end of September.8

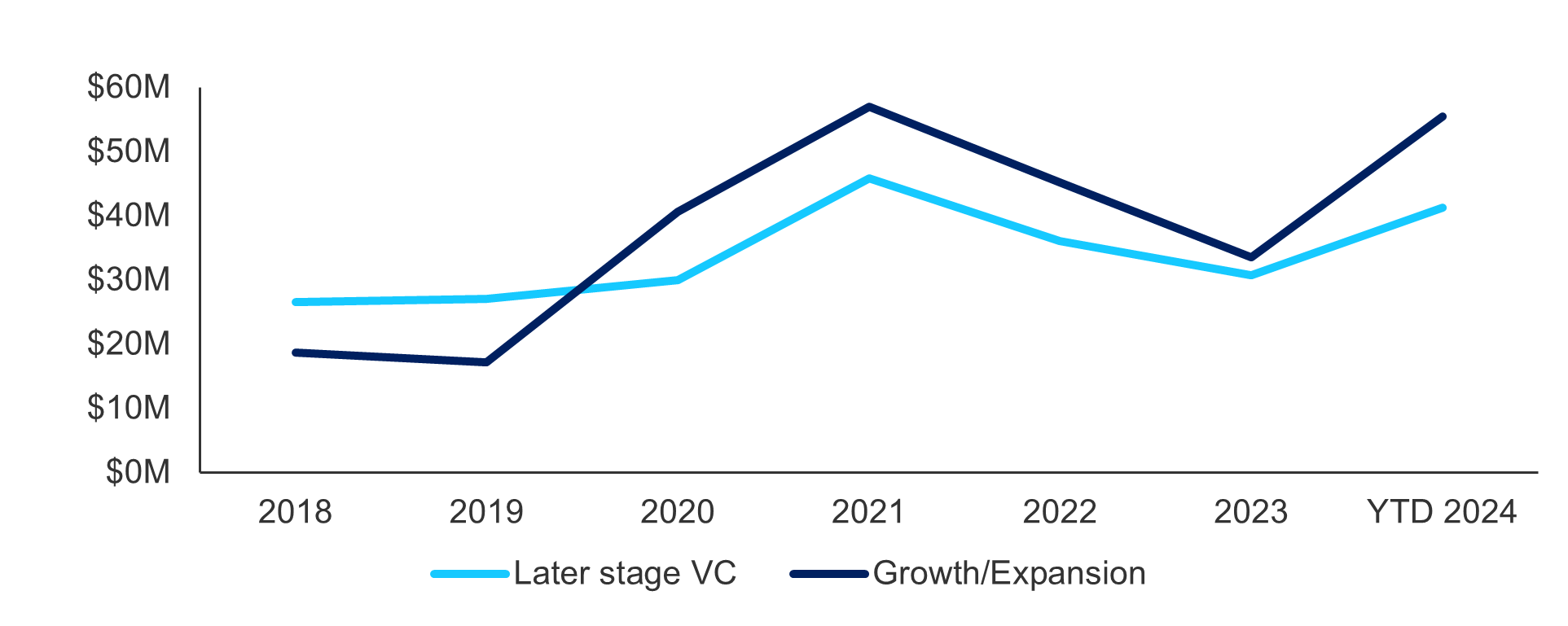

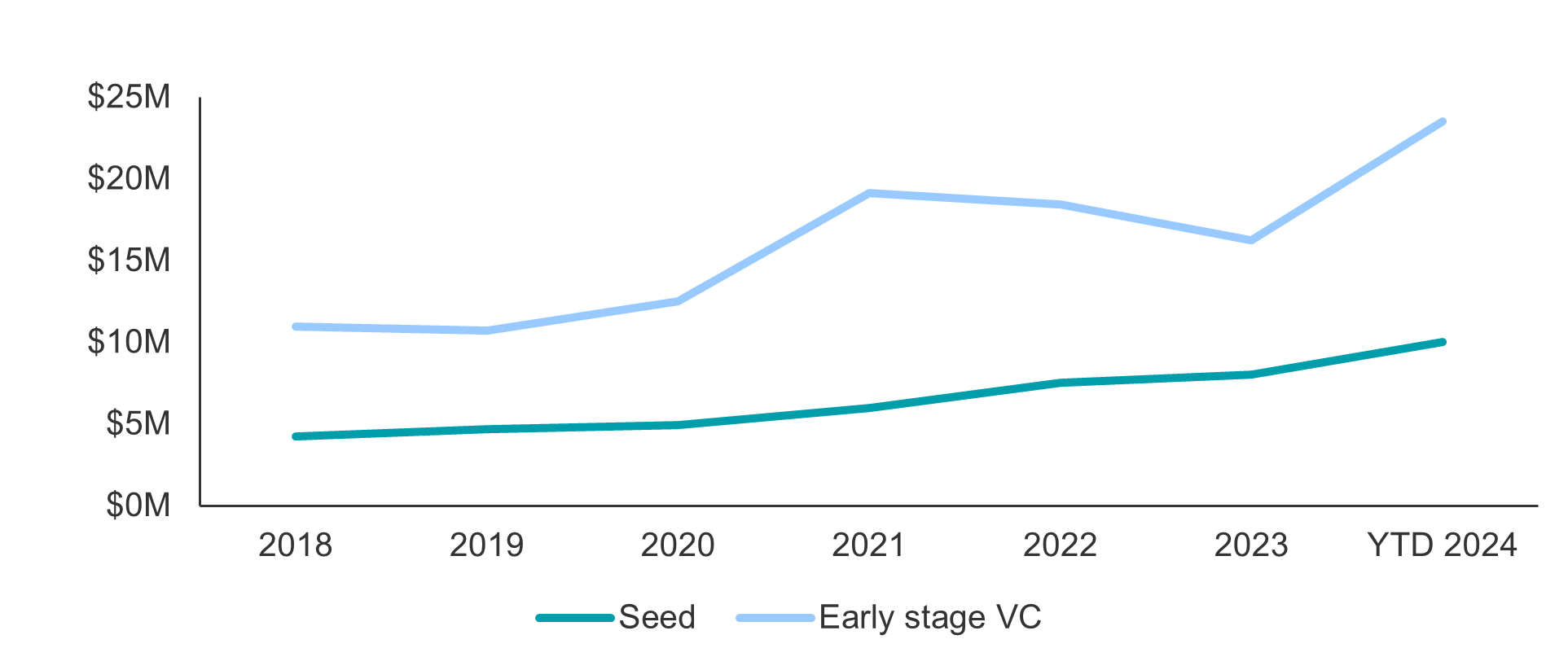

US venture capital is taking somewhat longer to recover. New deal and exit activity remain muted, and our mid-year prediction of IPO exits increasing in the second half of 2024 fell short. Yet the performance of some of the venture capital-backed IPOs that did occur in 2024 have been strong: In early November, Rubrik was trading 20% higher than at IPO,9 Astera Labs was more than 50% higher,10 and Reddit was 160% above its IPO price.11 Further, venture capital valuations across all stages have recovered from their post-correction lows in 2023. These are positive signals that will likely foster more exits, especially in sectors that meet today’s high demand for innovation, such as artificial intelligence (AI)-related businesses, climate tech, cybersecurity, and health tech.

Median global venture capital (VC) pre-money valuations by stage

Source: Pitchbook, as of September 30, 2024. For illustrative purposes only.

EMEA: Lower rates and regional tailwinds

With inflation running close to the 2% target, Europe’s interest rates have begun to fall, and its economy is back to 1% growth targets. Moves by the ECB and Bank of England (BOE) have stabilized market uncertainty and helped boost Europe’s private equity market.

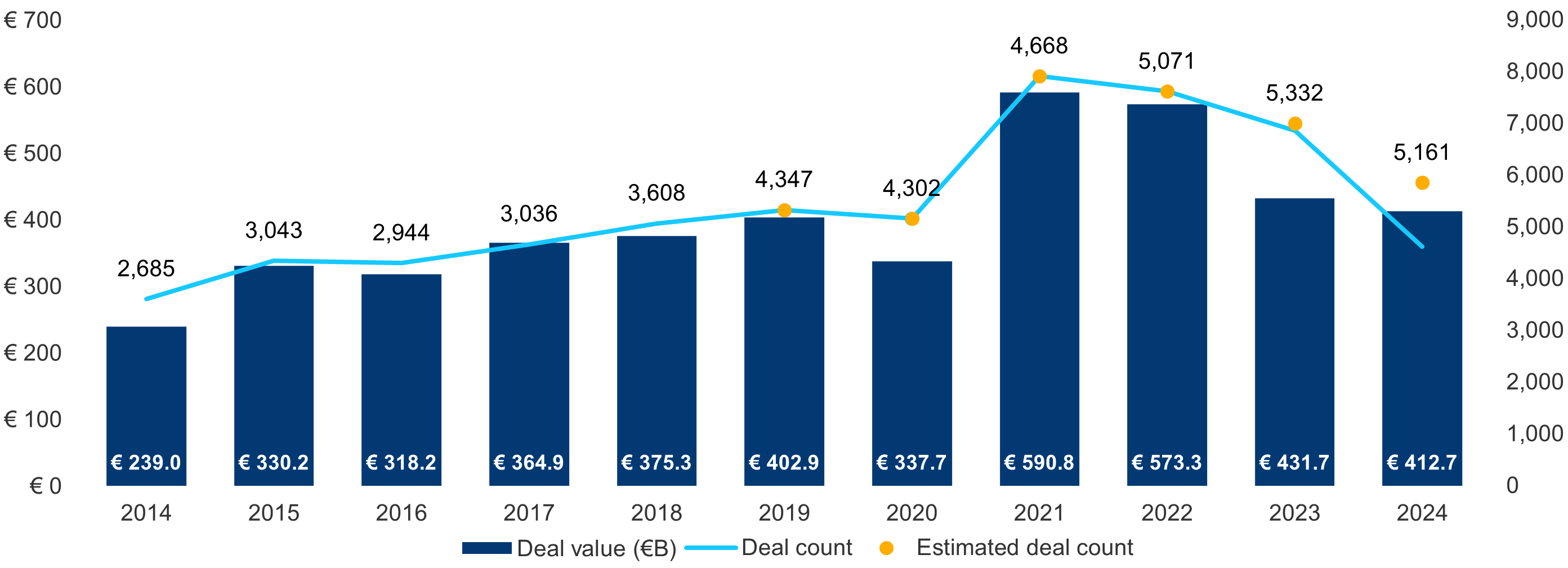

Private equity investment activity is now starting to tick upward. By Q3 2024, buyout funds had invested €413 billion in European deals, not far off the €432 billion for the full year of 2023, and this year should close out ahead of last with PitchBook forecasting that deal values are poised to grow by 28% and volumes by 12% by year-end.13 Unlike other regions, European fundraising also continues to be strong, with €110 billion garnered in the first three quarters of 2024 (against €122 billion for full year 2023, the second highest total on record).14 With the pipeline of European managers coming to market next year looking particularly promising, fundraising and dealmaking momentum is likely to continue through 2025.

EMEA PE deal activity

Source: PitchBook | Geography: Europe | As of September 30, 2024.

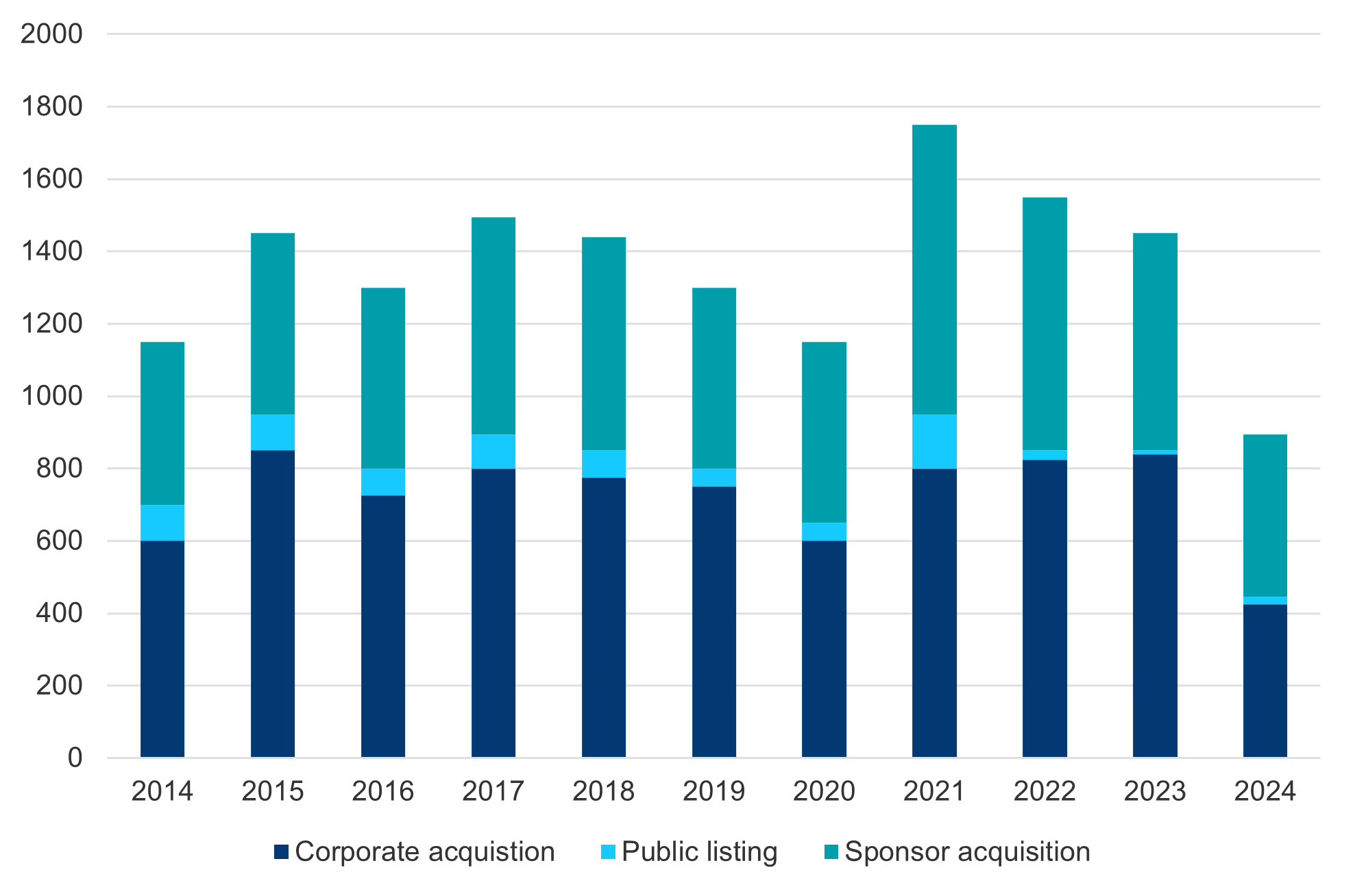

Exits, however, have been slower to emerge than we had anticipated earlier in the year. After a handful of successful exits via IPO in the first half of the year, including EQT-backed Galderma, listing activity has slowed. And while IPOs have never been a major route to realization in Europe, corporates have taken more of a back seat in acquisitions from the region’s private equity portfolios. With healthy levels of dry powder and a backdrop of lower interest rates, buyout managers took up some of the slack with sponsor-to-sponsor and GP-led activity overtaking trade sales in terms of value and volume in the first three quarters of 2024 for the first time in a decade.15 Exits are therefore on course to remain flat by value in 2024, recording €202 billion through the end of the third quarter (against €273 billion for full year 2023).

However, we are starting to see more European portfolio companies readying for potential sale, suggesting that the first quarter of 2025 could be the start of a long-awaited uptick in distributions.

PE exit count by type

Source: PitchBook, European PE Breakdown Q3 2024. As of September 20, 2024.

The region’s economic recovery still faces challenges, including geopolitical conflict and a need to shift more traditional industrial companies to new business models that incorporate digital technologies. Yet Europe’s private equity industry is well placed to pursue value-oriented buyout deals and position portfolio companies to meet and address these challenges. Europe’s middle-market firms have a long history of implementing operational improvements and consolidating businesses in often fragmented industries and across borders.

Further, GPs in the region are taking advantage of several tailwinds supported by European regulations and incentives. Within the energy transition, there are strong themes, from producing sustainable materials to the development of infrastructure required for energy-efficient cities. There are also significant growth opportunities stemming from the application of AI and automation as well as increased spending on defense by European countries and the reshoring of supply chains. We believe that managers with the skills and resources to capitalize on these opportunities will be able to generate strong returns for investors as proven by prior cycles within the region.

APAC: Market momentum based on regional cycles

Asia-Pacific (APAC) is far from a homogenous region, and the cycles in many individual markets can paint a very different picture from what we see globally — some of these markets are experiencing up-cycles with signs of positive momentum.

While fundraising across the APAC region remains muted at $24 billion as of Q3 2024, with the decline largely driven by a continued slowdown in the China private equity market, the story is not uniform: In Japan, 2024 is set to be a record year for private equity fundraising within the local market. Anchored by both local and international LPs, this market has seen strong demand with +108% year-over-year (YoY) growth through Q3 2024, reaching $7.6 billion in new funds closed. New investment activity can be lumpy at times in Japan, driven by a few large-cap transactions in a given year; however, the government’s push to improve capital efficiency for public companies is creating new sources of deal flow in the forms of corporate carve-outs and potential take-privates. These opportunities only add to the country’s deepening pool of succession-related deals as aging founders, many in their late 60s to early 70s, look for long-term partners to drive their companies’ future growth.

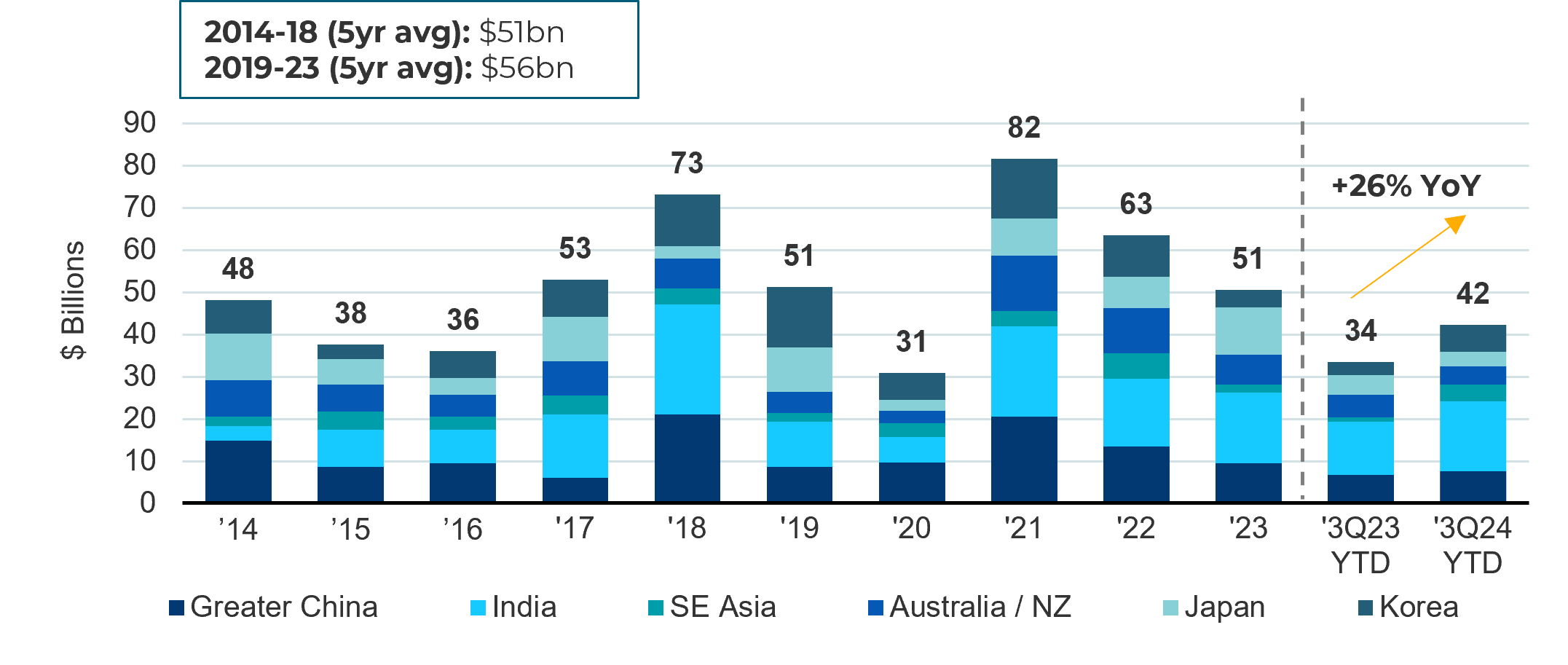

Private equity and venture capital investment activity across APAC in the first three quarters of 2024 is tracking in line ($59 billion) with the same period in 2023, supported by buyout deals in Japan, Korea, and India and several large transactions in China.16 Positive momentum is expected to continue with a handful of large deals already signed that will close by the end of the year.

More thematically, the consumer-led growth story in Asia continues, but with some new twists. Consumers today are more value-oriented and looking to spend in new categories that cater to their different needs across life stages, from the young and digitally native to the so-called “silvering” population. With total disposable incomes across the region projected to double in real terms from 2021 to 2040,17 the growth in spending power is fueling deal opportunities in areas such as healthcare, financial services, and consumer services. Similar to the US, Asia is also seeing its first wave of generative-AI related investments emerging across the region that could disrupt traditional business models in the decade to come.

On the other hand, Asia also has a compelling supply side story, shifting from low-end manufacturing to higher valued-added production capabilities, led by technology innovation. This is especially true in areas such as hardware, robotics, and climate-related technology. Asia today already leads the world in terms of wind, solar, and battery technology.

We have seen GPs executing on many of these investment themes through both venture capital and growth-oriented buyouts, particularly in markets like India where leverage levels remain low and pricing high.

Private equity-backed exits in APAC*

Source: AVCJ, APER, supplemented by HarbourVest analysis of other activity in the market, as of September 30, 2024. Past performance is not a reliable indicator of future results. For illustrative purposes only.

* Excludes exits by sovereign wealth funds, RMB funds and other non-private equity financial investors.

Looking at the APAC exit activity, there are a few bright spots with overall exits volume increasing 26% YoY as of Q3 2024, and India representing 40% of the total. India’s IPO market has shined in 2024.18 In the first three quarters of 2024, there were over 200 IPOs launched by Indian companies19 taking advantage of strong investor confidence and a burgeoning pool of domestic investors participating in equity markets. Post-IPO share price performance of private equity-backed companies has also been very strong, signaling strong demand for high-quality listings. With Indian elections earlier this year resulting in continuity for Narendra Modi’s pro-business government, and policies targeted at transforming the economy through technological innovation, the momentum around infrastructure buildout — both the physical and digital — is set to continue.

Three trends for 2025: Secondaries, an uptick in deal flow, and evergreens

Against this broader macro and regional market backdrop, we believe three main trends will play out over the coming year.

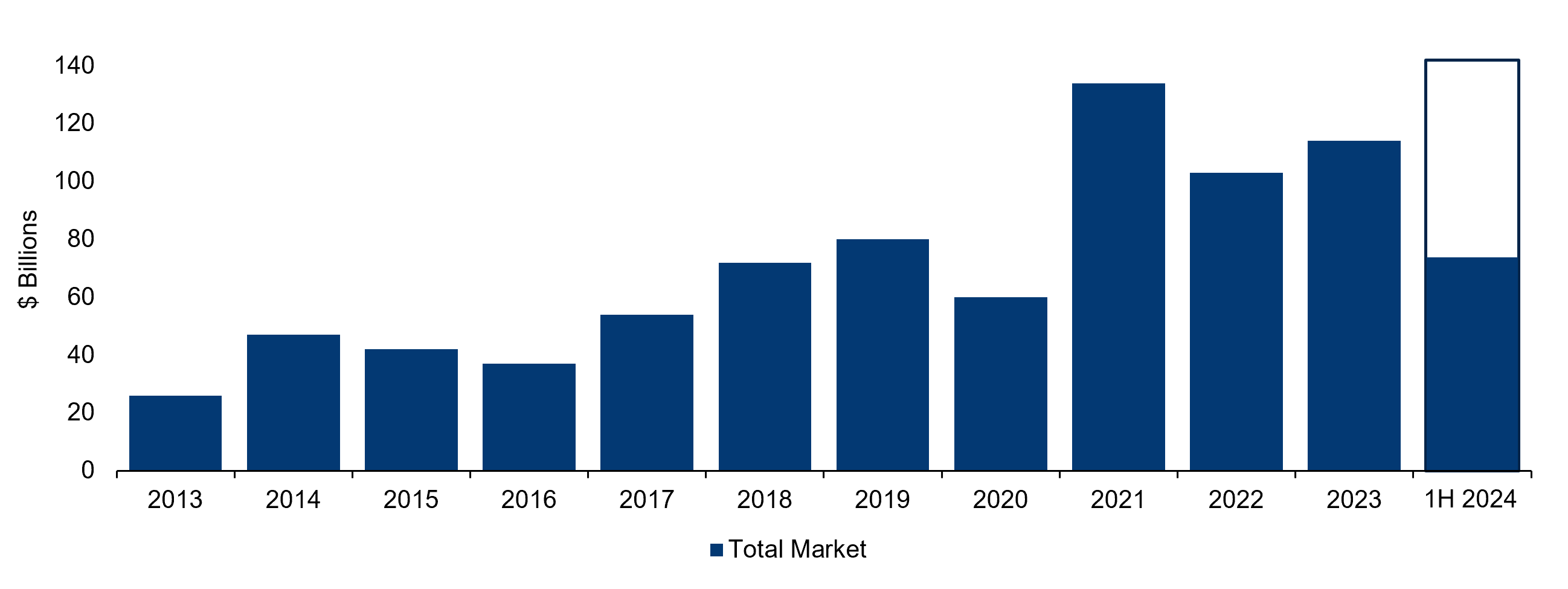

1. In the ongoing search for liquidity, secondaries continue to surge

As we close out 2024, the secondaries market is on course for a record-breaking year. With around $70 billion of deal volume locked in by the first half of 2024 (H1 2024),20 predictions of a full-year total of at least $140 billion seem close to the mark.21 We have seen high transaction activity and a strong pipeline of deals building through the second half of 2024, consistent with the historical pattern of a year’s final quarter often being the most active period for secondaries transactions.

Private markets secondary volume

Source: Evercore, H1 2024 Secondary Market Review, July 2024

LPs’ and GPs’ quest for liquidity has been a key driver of volume as exit activity continued to disappoint in most markets. Through the year, LPs have sought to release capital via secondary portfolio sales for a variety of reasons. To that end, in H1 2024, LP-led transactions accounted for 57% of the market’s volume.22 Meanwhile, GPs continued to embrace the secondary market as a means to offer their LPs the option for liquidity while also holding on to, and building further value in some of their best assets.

Even if, as we anticipate, the exit market picks up through 2025, secondaries transaction volume is expected to remain robust for both LP-led and GP-led deals. Private equity asset turnover is still a relatively small proportion of the overall market (at around 2%), and this figure should grow over time. LPs are becoming more tactical in managing their portfolios and are using secondaries to fine-tune their exposures, while GPs increasingly see the secondaries market as an attractive means for harvesting liquidity from their star-performing companies while remaining invested in them.

The secondaries market is also expanding in line with the increasing diversity of private markets assets. Secondaries are well suited to the long investment horizons of infrastructure assets, and this part of the market has grown over recent years. GP-led infrastructure secondaries made up 8% of secondaries transaction volume for H1 2024.23 Meanwhile, private credit secondaries are attracting more attention as this corner of private markets continues to grow.

Secondaries fundraising continues apace, as LPs increasingly see exposure to this market as a core part of their portfolio and as capital from high-net-worth investors enters the market via evergreen vehicles. Even so, the deepening pool of available assets in the underlying private markets space means there is still plenty of scope for growth over the coming years. There was an estimated $253 billion of capital available for the secondaries market at H1 2024,24 yet this figure is dwarfed by the scale of private markets overall, where assets under management are projected to grow to more than $18 trillion by 2033.25

2. An uptick of deal activity across private markets

As we approach 2025, private markets new deal activity is starting to accelerate. Investments have already resumed a steadier flow in 2024, with quarter-on-quarter rises in new buyout deals as the year progressed in both the US and Europe,26 while new venture capital rounds in these regions appear to have at least bottomed out.27 Encouragingly, we are seeing a healthy flow of new venture deals in the works, anchored on AI and one of the most dynamic innovation cycles we have seen in decades, as well as multiple large cap private venture deals being done at unprecedented valuations ranging from the $10 billion to-$100+ billion range.

One of the biggest blocks to getting deals over the line in recent times is now starting to break down — the gap between buyer and seller price expectations. While these gaps are always a feature of dislocated markets, the wide bid-ask spread has been especially persistent in this cycle. With interest rates finally starting to trend downward and an active broadly syndicated loan (BSL) re-emerging as a credible source of debt, we are seeing credit spreads tighten for senior private credit, which should make valuations more digestible to sponsors and help close the bid/offer spread that has been an impediment to many deals getting done.28 This, combined with falling multiples in buyouts, is helping buyers and sellers reach agreement on price and get more deals over the line.

Supporting these trends is the large amount of uninvested capital for private equity to deploy. This has reduced slightly from record levels in 2023, but given that approximately 26% of uninvested capital at buyout funds’ disposal is four or more years old,29 the pressure is on for GPs to up their investment pace or face the unpalatable prospect of releasing their LPs from some of their commitments. A quickly approaching debt wall due to be refinanced over the next 24-36 months is expected to further catalyze increased deal activity. Against this backdrop, we’re already seeing the chill come out of the sponsor-to-sponsor market, with realizations to financial buyers rising 150% globally in terms of value in the first three quarters of 2024 (to $129 billion) relative to the same period in 2023.30 And, although there is a high level of regulatory and anti-trust scrutiny, which is inhibiting or even prohibiting consolidation among large-cap strategics, the mid-market has been very active with strategics scooping up synergistic private equity backed assets at attractive prices for the sellers. This is leading to warming exit activity, while also increasing the flow of new deals.

Adding to this mosaic of factors contributing to a more positive deal environment, we see the pipelines for private credit as being particularly robust, reflected through higher transaction activity. Given that, we believe junior credit will continue to play an important role in financing new deals and refinancing existing portfolio companies through 2025, presenting a particular opportunity for seasoned and agile managers. On the flip side, interest rates, while on a downward path, are unlikely to fall significantly. Sponsors will therefore need to think creatively about how they employ private credit in their portfolio companies to ensure they can still build value. By opting to secure junior debt that pays interest in kind, as opposed to in cash, GPs can free up company cash flows to reinvest in company growth.

We are cautiously optimistic that a more temperate climate and pro-growth posture of the US president-elect will further thaw private markets activity, but we recognize that risks remain. Despite the backdrop of geopolitical conflicts and the potential for future inflationary spikes, public market indices are at record levels and priced in a way that is projecting a near perfect outcome — a scenario in which any setback could affect the emerging private markets recovery. However, absent any major shocks, the stage is set for continued momentum in private markets through 2025, with new deals trending upwards, followed by exits and then fundraising, as confidence and liquidity gradually start to return.

3. Rapidly expanding access to private markets is driving innovation

While institutional investor appetite has historically fueled private markets’ remarkable rise, it’s clear that they will be joined by individual investors in driving the next phase of the industry’s growth — growth that is already unfolding at a rapid pace.

Globally, the number of high-net-worth individuals (HNWI) is increasing, having grown by more than 1 million people or $3.8 trillion YoY from 2022 to 2023. In total, these HNWI had nearly $90 trillion in assets as of 2023. In 2024, given broad market gains, this figure is no doubt higher. Importantly, these investors are choosing alternatives — allocations from this group rose from 13% in 2022 to 15% in 2023, with 68% of those surveyed indicating they plan to increase their private equity investments in 2024. At the same time, there is rising demand from individuals managing their own pension investments and from defined benefit pension schemes, or 401(k)s, in the US.

Traditional public equity investing is losing some of its luster for these investors as the number and range of companies on public exchanges continues to dwindle. In 1996, there were 8,090 companies listed in the US; in 2022, there were fewer than 4,650,31 with the top 10 stocks by market capitalization accounting for nearly 30% of the public equity market in early 2024.32 It’s this kind of concentration, along with the return-enhancing benefits that private markets can potentially offer, that is luring individual investors.

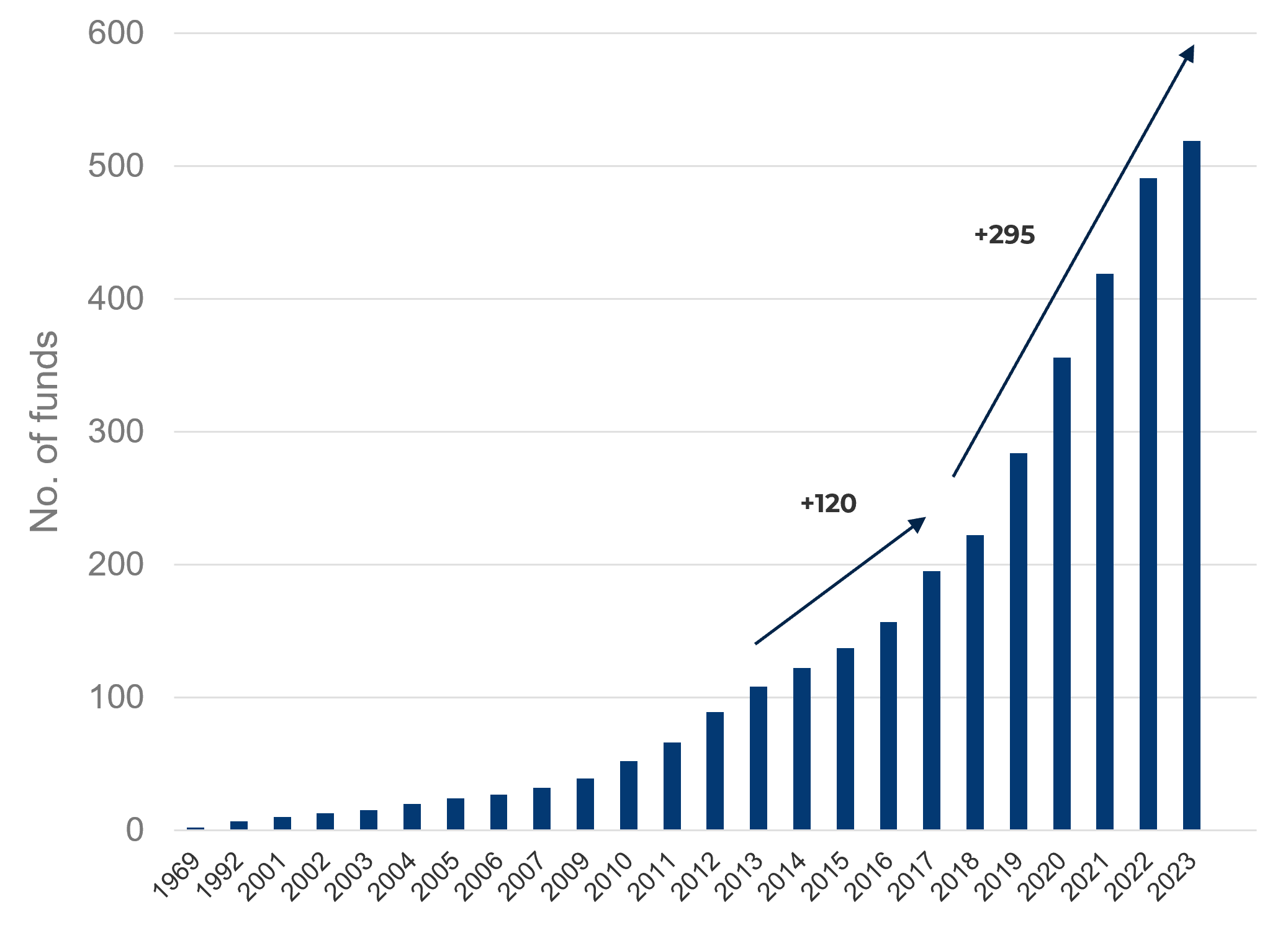

These trends are leading to product innovation as asset managers find ways of creating vehicles to meet the needs of individual investors across both savings and retirement pools. Evergreen funds are emerging as one way of solving for high-net-worth investors’ desire for more liquidity. While early adopters of evergreen solutions were in the credit, real estate, and infrastructure markets, more recently the number of these vehicles targeting wealthy clients more than doubled between 2018 and 2023 to reach 520, managing in aggregate over $350 billion.33

Evergreen fund growth

Given the expanding set of products to an expanding set of investors — from concentrated direct portfolios to diversified secondaries to multi-asset classes — evergreens can often accommodate the varying preferences of different investors, from diversification to the simplification of tax record keeping, etc. Regardless of the design mechanism that can be used to accomplish goals for investors, what they share is an underlying fundamental belief in private markets as an asset class.

The potential growth of evergreens is significant and exciting, but not without risks, largely due to the significant differences in operating an evergreen versus a closed-end fund. Fundamentally, scale is essential to meet the influx of demand, to effectively maintain the level of liquidity required of evergreens, and to manage these new structures in a way that does not come at the expense of portfolio performance for both these funds and other portfolios managed by the same GP. Although regulated, the market is growing rapidly and has yet to be fully tested. Over the medium term, as market disruptions test new structures, there will likely be a wide dispersion of returns across different managers, funds, and strategies.

Given this, we will no doubt see further innovation in the years to come as asset managers devise new ways of meeting the needs of individual investors by creating new wrappers to customize liquidity profiles, exposures, access points, and investment horizons. It’s an exciting and emerging area — one that is sure to grow and mature as it is tested in the years to come.

A gathering wind leads to brighter skies

Private markets’ capacity for uncovering opportunities and actively building value in even the gloomiest of times makes for a highly resilient, all-weather asset class. This resilience has been reinforced again through the recent interest rate shocks and geopolitical turbulence that have marked the past two years. While deals, exits, and fundraising have all been more muted, the market didn’t stall. But it did pause for breath, focusing on the highest-quality deals in an uncertain market, eschewing riskier assets, and creating value in high-quality businesses while waiting out the storm for better exit conditions. Meanwhile, secondaries have stepped in to ease the significant and inevitable liquidity pressures that LPs and GPs have faced in what has been a challenging dealmaking market.

While certain risks remain in light of geopolitical conflict, we are optimistic that recent tailwinds will yield bright skies ahead. In the past, public market performance has been a leading indicator for private markets, and we believe the strong gains in stock markets in 2024 are setting the tone for higher activity levels in private markets into 2025. Indeed, as we predicted in our half-year outlook for 2024, confidence is returning, dealmakers are getting back to the table, IPO markets are improving, and there are early signs of exits trending upward.

And as activity picks up, we are confident that the secular trends of disruptive innovation, digitalization, aging populations, sustainability, and energy transition will offer significant investment opportunity and the potential for strong returns.

https://files.pitchbook.com/website/files/pdf/Q3_2024_Global_MA_Report.pdf

https://pitchbook.com/news/reports/q3-2024-global-pe-first-look#downloadReport

https://pitchbook.com/news/reports/q3-2024-global-pe-first-look#downloadReport

https://pitchbook.com/news/reports/q3-2024-global-pe-first-look#downloadReport

https://files.pitchbook.com/website/files/pdf/Q3_2024_US_PE_Breakdown.pdf

https://www.bain.com/insights/year-cash-became-king-again-global-private-equity-report-2024/

https://files.pitchbook.com/website/files/pdf/Q3_2024_US_PE_Breakdown.pdf

https://files.pitchbook.com/website/files/pdf/Q3_2024_US_PE_Breakdown.pdf

https://files.pitchbook.com/website/files/pdf/Q3_2024_European_PE_Breakdown.pdf

https://files.pitchbook.com/website/files/pdf/Q3_2024_European_PE_Breakdown.pdf

https://files.pitchbook.com/website/files/pdf/Q3_2024_European_PE_Breakdown.pdf

Source: AVCJ, APER, supplemented by HarbourVest analysis of other activity in the market, as of September 30, 2024.

https://www.euromonitor.com/income-and-expenditure-in-asia-pacific/report

EY Global IPO Trends Q3 2024 https://www.ey.com/en_gl/insights/ipo/trends

Ibid

https://www.spglobal.com/en/research-insights/market-insights/private-markets

https://files.pitchbook.com/website/files/pdf/Q3_2024_US_PE_Breakdown.pdf https://files.pitchbook.com/website/files/pdf/Q3_2024_European_PE_Breakdown.pdf

https://files.pitchbook.com/website/files/pdf/Q3_2024_PitchBook-NVCA_Venture_Monitor.pdf

https://files.pitchbook.com/website/files/pdf/Q3_2024_US_PE_Breakdown.pdf

https://data.worldbank.org/indicator/CM.MKT.LDOM.NO?locations=US

https://www.jpmorgan.com/insights/global-research/markets/market-concentration

This material is solely for informational purposes and should not be viewed as a current or past recommendation or an offer to sell or the solicitation to buy securities or adopt any investment strategy. The opinions expressed herein represent the current, good faith views of the author(s) at the time of publication, are not definitive investment advice, and should not be relied upon as such. This material has been developed internally and/or obtained from sources believed to be reliable; however, HarbourVest does not guarantee the accuracy, adequacy or completeness of such information. There is no assurance that any events or projections will occur, and outcomes may be significantly different than the opinions shown here. This information, including any projections concerning financial market performance, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons.