October 16, 2024 | 6 min read

Many LPs are feeling an extended liquidity squeeze, trying to fund (re)investments while stuck between infrequent distributions and slowed IPO activity. Despite the IPO market showing some signs of recovery, the backdrop remains lukewarm, and the outlook is uncertain at best. But, finding liquidity and opportunities for value creation in today’s market is far from singularly hinged on the IPO window reopening. In fact, several pockets of the private equity market have shown resilience throughout 2023 and 2024.

Private equity’s small and middle-market segments tend to be less beholden to public markets, creating more optionality with respect to finding liquidity. We believe this is particularly the case for small and middle-market opportunities within direct co-investing strategies, which tend to be more diversified than typical private equity funds and often have several assets primed for exit transactions regardless of the cycle. Understanding the nuances of the small and middle-market co-investment landscape is crucial to uncovering liquidity and optimizing risk-adjusted returns during more challenging business conditions.

Making sense of the IPO debate in 2024

After a two-year lull in the IPO market, unsurprisingly, those with a vested interest in its recovery (e.g., large investment banks) have been shouting the loudest in forecasting a resurgence. Predictably, these commentators also advocate that larger listings (which often come with higher fees for the investment bank) are likely to be the most executable and beneficial for stakeholders in the current environment.1

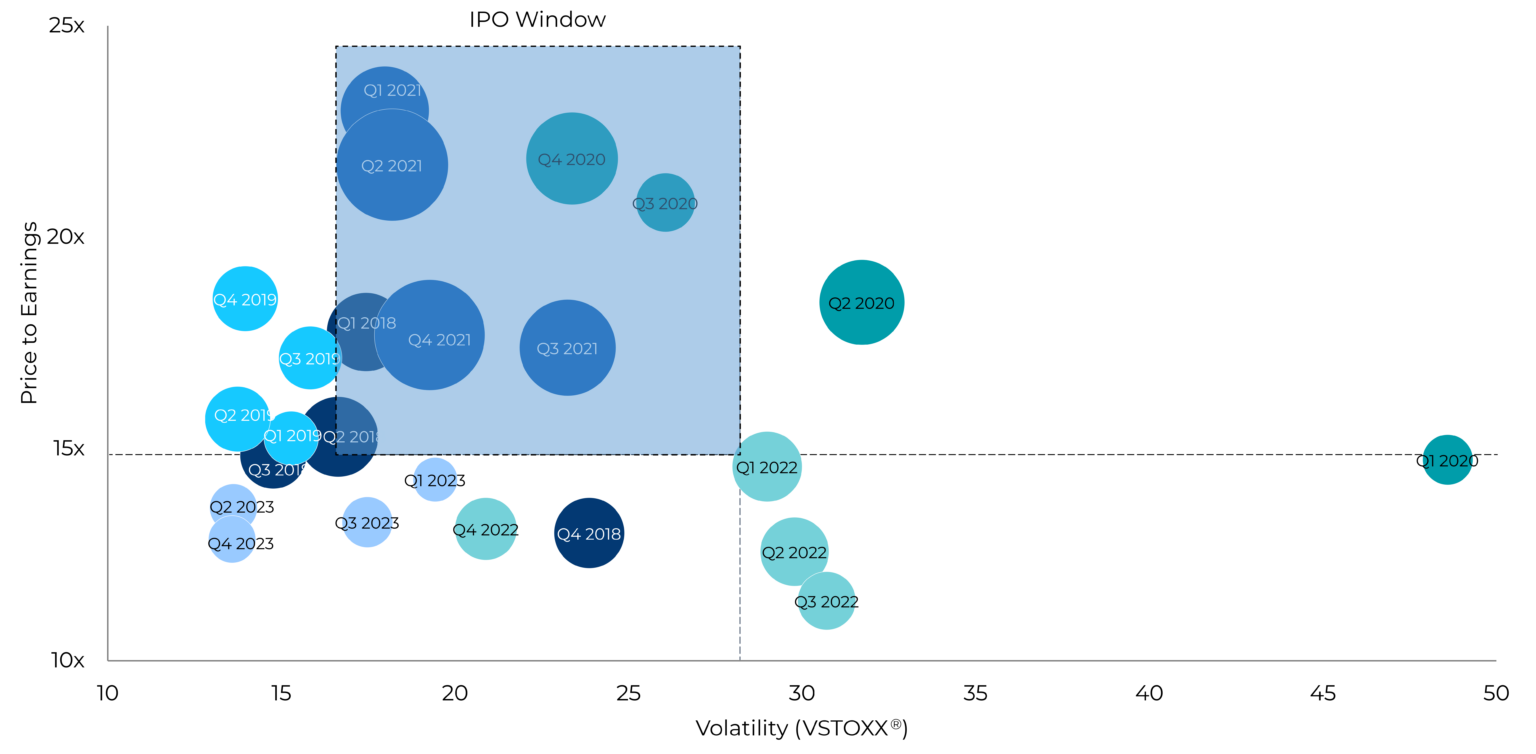

This argument, however, hinges on two distinct factors: Higher valuations in public markets and lower volatility. The chart below illustrates a clear link between higher IPO counts when price to earnings ratios are elevated and volatility is lower, but few commentators feel there is sufficient data today to decisively support a forecast one way or the other. We would tend to agree that the timing and reopening of the IPO window to historic levels remains uncertain.

Quarterly IPO count by select IPO window metrics (2019-2023)

Source: Pitchbook, data is based on European IPOs and Euro Stoxx 50 Volatility Index as of December 31, 2023. Bubble size is scaled based on IPO count for the quarterly period noted.

Liquidity beyond IPOs: Think small and middle-market

With IPO uncertainty facing ongoing macro and geopolitical risks, and a growing dissatisfaction among LPs given the lack of urgency GPs are placing on liquidity and distributions,2 what other routes besides IPOs are available to GPs to return capital and realize meaningful value for investors? And what private equity strategies are best placed to exploit these other exit pathways?

First, while IPOs are an important exit avenue, they have never been the leading path to providing distributions to LPs. In fact, since the Great Financial Crisis, IPOs have consistently accounted for ~14% of exit activity by average volume and only 15 by average exit count.3 Moreover, acquisitions, including sales to strategic buyers and financial sponsors, have played a significant role in returning cash back to LPs, particularly during 2022 and 2023,4 and these exit opportunities have grown in importance over the last several years given the state of the IPO landscape.

US private equity middle-market exit count by type

Source: PitchBook, US exit count data as of March 31, 2024.

Clearly, several viable alternative paths to liquidity remain active outside of the IPO route, particularly for small and middle-market companies. We believe these smaller companies by their nature tend to be less operationally and financially developed than their larger-cap counterparts, which can inherently create more potential for value creation. Further, value creation can come in a number of forms for small and mid-sized companies including, but not limited to: geographic or product expansion executed organically or through M&A, technology adoption, professionalization of the management team, or adoption of more competitive pricing structures and go-to-market strategies. These companies also have lower total enterprise values which we believe results in smaller acquisition check sizes. In the current environment, this positions small and middle-market businesses as more viable acquisition targets driving up exit activity, and as a result, potential distributions.

As base rates ease and spreads tighten, the middle-market buyout environment stands to be a key beneficiary. Not only can platform acquisitions become viable targets — an important investment strategy in the middle-market space — they can also increase the ability for add-on investments. A large majority of add-ons are sourced in the middle-market segment. Add-on acquisitions account for three out of every four buyouts in the US private equity deal market today, and they drive 54.7% of all deal value in the middle market.5 Portfolios with operating companies exhibiting low leverage, high growth, and steadily improving margins will likely become key targets. This in turn has the potential to drive valuation marks and ultimately distribution activity in middle-market portfolios that have companies with these characteristics.

While the opportunity for value creation in the small and middle-market is potentially significant, this segment of the market typically exhibits a greater dispersion of returns relative to the larger end of the market. That higher dispersion means that the opportunity for alpha generation is greater, but the risk of choosing the wrong manager (or transaction, in the case of co-investing) is larger too. For those choosing to invest in the small and mid-cap market, manager/deal selection and data-driven due diligence is critical.

Understanding the co-investment angle in today’s shifting landscape

As GPs search for new investors to continue their fundraising in a more challenging environment, co-investors are becoming increasingly crucial to unlocking a particularly attractive deal that might otherwise remain out of reach to the GP given their current LPs’ concentration limits or fundraising timelines. From an LP’s perspective, a co-investment approach offers: access to top tier GP deal-flow through a solutions-orientated approach, diversification by multiple metrics (GP, EV, industry, geography, value creation approach etc.), and a lower fee burden compared to many other forms of private markets investing.

Co-investment portfolios, especially those that focus on small and middle-market companies, can provide investors with a level of diversification that offers resilience and the potential for liquidity through various business and market environments. Understanding how the co-invest market intersects the small and middle-market private equity landscape is crucial to unlocking the potential liquidity and performance benefits.

Over the past 10-15 years, the private equity industry has evolved into a highly specialized asset class. The number of specialist firms swelled by over 25% from 22.9% in the decade from 2000-2010 to 30.1% during the period from 2010-2020 — with the count of generalists falling more than 6% over the two-decade period.6 This has led to an ecosystem where many GPs have developed focused teams in a select number of industry segments. While this has created GPs with strong track records in their focus markets, it can also create concentration risk for LPs allocating to only a limited subset of sector-focused GPs. Co-investment funds have established themselves as a place where investors can now access the sector expertise of underlying private equity managers while mitigating risk through a broadly diversified co-investment portfolio.

GP specialization rises over the decade changing the co-invest landscape

Source: PitchBook, data as of December 31, 2020. Data represents US GPs that qualified for all three vintage cohorts. The style classification for each cohort is based on the previous 10-year deal history.

As investors approach the shifting co-investment ecosystem, it is important to understand that in today’s backdrop GPs are increasingly searching for co-investment partners that can offer more than simply writing an equity check to aid in funding transactions. GPs are seeking out friendly co-investor partners providing a solutions-based approach rather than another private equity firm that can potentially disrupt the governance structure of a business and cause a distraction to management teams that are actively executing on a business plan.

While syndicated deals continue to have relevance, in today’s more constrained credit and exit environment, GPs are seeking partners that can also co-underwrite, warehouse, lead and price new rounds of capital, and/or provide bespoke liquidity solutions. A solutions-based approach is increasingly separating the winners from the losers in today’s co-investment allocation process, particularly in the small and middle-market where there is often significantly greater potential for outsized returns.

Key takeaways

With an uncertain outlook for IPO activity going forward, the market backdrop is creating new dynamics outside of the traditional large and mega deals of just a few years ago. A spotlight on the small and middle-market segments, particularly in the context of direct co-investment strategies, is showing notable resilience and potential for value creation. At the same time, structural nuances and a greater number of liquidity levers at the disposal of small and middle-market GPs are providing LPs the potential for more meaningful distributions. Coupling these current dynamics with an evolving co-investment landscape, allocators should remember:

- Small and mid-sized companies by nature are nimbler with numerous paths for creating value and a range of exit pathways that are more insulated from changing macroeconomic conditions and volatile public markets.

- In today’s market backdrop, the structural features of small and middle-market companies is offering the potential for greater LP distribution activity.

- Today’s current co-investment environment is offering allocators access to top-tier GPs with attractive deal economics that they may not have had access to in previous market cycles.

- In a more difficult fundraising environment where GPs are increasingly searching for bespoke solutions-based approaches to solve a myriad of financing and business needs, a co-investment strategy in the small and middle-market is offering access to potentially meaningful liquidity.

- Reuters, Europe sees a two-speed IPO recovery as smaller deals lag, May 10, 2024.

- Bain & Company, “Searching for Momentum: Private Equity Midyear Report 2024” and ILPA survey of limited partners poll (n=148).

- Pitchbook, 2023 Annual US PE Middle Market Report and Q2 2024 US PE Middle Market Report.

- PitchBook, 2023 Annual US PE Middle Market Report.

- PitchBook, Q2 US PE Middle Market Report.

- PitchBook, data as of December 31, 2020, based on US GP style classification between 2000-2020.

HarbourVest Partners, LLC (“HarbourVest”) is a registered investment adviser under the Investment Advisers Act of 1940. This material is solely for informational purposes; the information should not be viewed as a current or past recommendation or an offer to sell or the solicitation to buy securities or adopt any investment strategy. In addition, the information contained in this document (i) may not be relied upon by any current or prospective investor and (ii) has not been prepared for marketing purposes. In all cases, interested parties should conduct their own investigation and analysis of the any information set forth herein and consult with their own advisors. HarbourVest has not acted in any investment advisory, brokerage or similar capacity by virtue of supplying this information. The opinions expressed herein represent the current, good faith views of the author(s) at the time of publication, are not definitive investment advice, and should not be relied upon as such. This material has been developed internally and/or obtained from sources believed to be reliable; however, HarbourVest does not guarantee the accuracy, adequacy, or completeness of such information. The information is subject to change without notice and HarbourVest has no obligation to update you. There is no assurance that any events or projections will occur, and outcomes may be significantly different than the opinions shown here. This information, including any projections concerning financial market performance, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. The information contained herein must be kept strictly confidential and may not be reproduced or redistributed in any format without the express written approval of HarbourVest.